Read time: 3 minutes 56 seconds

We recently ran our first major audience survey - one of the questions was:

“What is your favourite Strategy Breakdowns essay?”

The votes are in.

Here are our top 5 most popular articles, as voted by you:

Honourable mention to 🎯 6 months into Strategy Breakdowns for scoring 4th in the voting (although we bumped it from the Top 5 since it’s more of a ‘Build-in-Public’ update than a typical ‘Breakdown’)

Enjoy.

— Tom

P.S. Nerdy side-note - this data is awesome because it’s now the most accurate metric we have for measuring topic popularity. All other metrics are highly influenced by other variables:

Unique Email Open-Rate → Subject Line popularity

Email Click-Through-Rate → Hyperlink quantity and relevance

Article Web Traffic → Success of the promotional social media post for that article.

Email replies or Web Comments → Comparatively small sample size, so not reliable enough.

Incredibly valuable for many things, like inferring popularity of potential future topics.

Today’s breakdown is brought to you by:

There’s a world where your CRM is powerful, easily configured, and deeply intuitive.

Attio makes that a reality.

Attio is a radically new CRM built specifically for the new era of companies. It’s flexible, easily configures to your unique data structures, and works for any go-to-market motion from self-serve to sales-led.

The next era of companies deserves a better CRM.

Join OpenAI, Replicate, ElevenLabs and more.

“We need a front-end developer by Tuesday, but it’ll take months to find someone in the US”

We use Athyna at Strategy Breakdowns – and a bunch of our friends do too. If you are looking for your next remote hire, Athyna has you covered. From sales to marketing, ops to engineering.

The secret weapon for ambitious startups. No search fees. No activation fees. Just incredible talent, matched with AI-precision, at lightning speed.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

The private transportation market is (1) incredibly competitive and (2) hyper-localised.

The moment Uber took off in the US, their unique application of Walras’s Law (matching excess supply with underserved demand) quickly took hold around the world.

Dozens of Uber copycats were born in the following years.

On one hand, this created global competition and made Uber a second-mover in many key markets.

On the other, it proved the Uber concept worked outside the US, and opened the door for Uber’s global expansion into pre-validated regions.

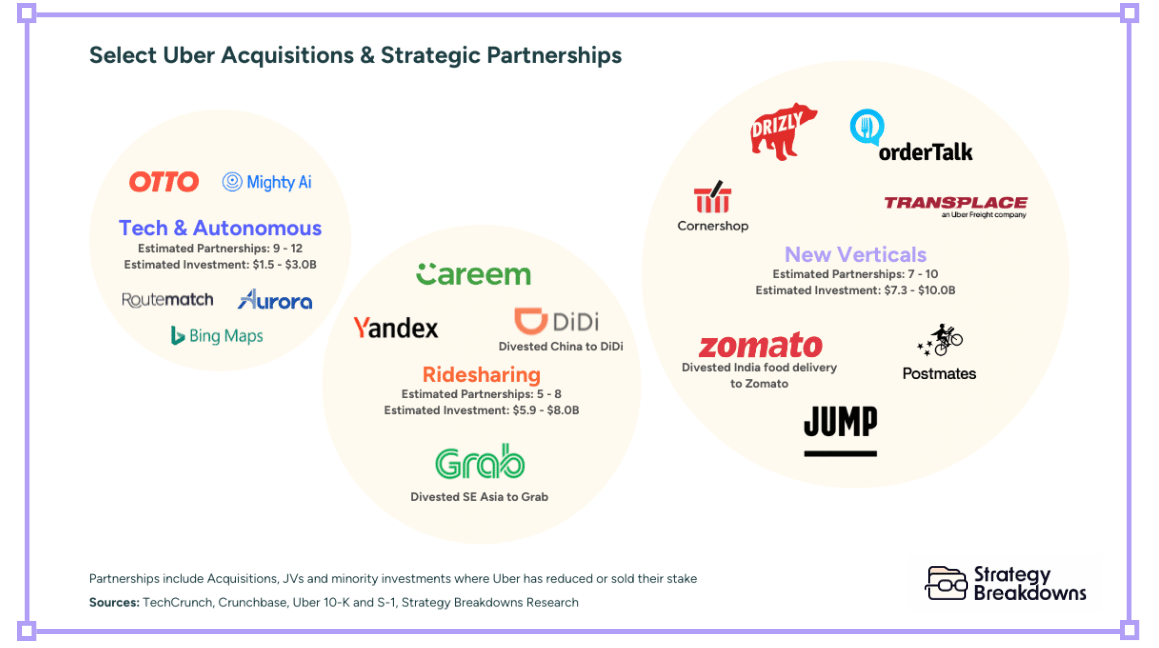

Uber took an aggressive, high-velocity approach: make 2-3 acquisitions annually to rapidly circumvent the regulatory complexities of new markets, and quietly eliminate competition along the way.

But, the acquisitions don’t tell the full story of Uber’s journey to profitability. While they were a great catalyst for entering new markets, they were also expensive investments and often didn't work out.

Uber has shown extreme discipline in acknowledging underperformance – which is no easy feat – and has developed the necessary habit of winding them down or divesting all together.

💡

Strategy Playbook: Spread your bets, but avoid the “sunk cost fallacy” by acknowledging losses, rather than chasing them.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Use acquisitions to open the door to new markets

Global expansion is tough. Companies often face two options:

Force entry, build infrastructure internally, manage regulatory complexity, and potentially trigger a price war

Acquire a partner that already solved for these challenges, and shortcut initial supply & demand generation

Uber generally chose the latter.

Over their ~15 year history, Uber has made around 40 acquisitions or large investments, spanning a variety of geographies and product lines, including:

Technology: deCarta and Geometric Intelligence helped them enhance their core experience

New Verticals: Cornershop and Postmates prepared them to gear up for the war against Doordash

By using cash to break into new markets, Uber dramatically accelerated the time required to understand if a market is viable for the long-term business.

2. Don’t chase losses

Not every Uber acquisition has been a success.

And they’d be the first to admit it. They’ve exited businesses nearly as readily as they’ve entered them:

Ridesharing: Uber offloaded much of their Asian and Eastern European operations in 2018

Technology: After multiple acquisitions over a decade, Uber sold their Advanced Technologies Group (ATG), which was responsible for autonomous vehicles, to Aurora in 2020 for $4 billion

New Verticals: At the start of 2024, Uber decided to sunset popular US alcohol delivery service Drizly

While many of these investments originally had strong strategic rationale – like blocking competitor Google’s development of self-driving unit Waymo – they are often rolled into business units that do not generate any cash, yet command significant R&D dollars. It is difficult to sustain these plays over time given pressure from investors.

In other cases, they were beaten out by better products, such as Doordash who are expected to control almost 70% of the US food delivery market by the end of the year.

Rather than sinking more time, internal resources, and money into these markets, they chose to wind many down in favor of their core business: ridesharing.

While realising financial losses is painful, they often only get worse with time. Uber knew the consequences of choosing the aggressive path – sometimes they were successful, other times not so much. But they always learned along the way (ie which markets, technology, and businesses are viable), which expedited their path to profitability.

In retrospect, given their discipline in winding down losing bets, most of the investments don’t seem so bad:

In fact, Uber often maintained some upside by acquiring an equity stake in the partners they divested to.

Meaning if those markets ended up being good picks in the long run, Uber will still be a winner.

3. Don’t lose the forest for the trees

The pandemic incidentally gave Uber a natural chance to evaluate their portfolio and rebaseline their bets.

In 2020 and 2021 they were busy surviving the pandemic and cutting corporate costs.

In 2022 and 2023, they were suspiciously quiet on the M&A front:

Ridesharing: Car Next Door (2022)

Technology: Transplace (2022)

New Verticals: N/A

Uber didn’t abandon their acquisition strategy. The word “acquire / acquisition” appears 263 times in their 2022 annual report.

They’re just moving to the next phase of the double-diamond.

Visual from BiteSize Learning

Uber’s M&A double-diamond:

→ Discover & Define: 2017 - 2019

→ Develop: 2020 - 2022

→ Deliver: 2023 - ??

They only posted 2 quarters with positive net income between their 2019 IPO and June 2023.

Rabbit Hole

The where: 3x high-signal resources to learn more

[19 minute read]

Uber began as a simple consumer proposition:

Match excess supply with demand.

But over the years, through their numerous acquisitions, that proposition grew increasingly complex. And so did their path to profitability.

Hackernoon’s Whitney Zim breaks down the evolution of Uber’s weird and wonderful business model.

[97 minute watch]

After a whirlwind couple of years through the pandemic, Uber’s CEO Dana Khosrowshahi talks about:

• M&A decisions and the future of the Eats business

• How they navigated Uber’s grand “turnaround”

• Upcoming technology investments to prepare them for the future

[3 minute read]

Uber’s strategy, and subsequently their valuation, have always been hotly contested by Silicon Valley analysts.

The team at Mergers & Inquisitions did a financial breakdown of Uber’s approach leading up to IPO in 2019, including:

• Uber’s free cash flows and contribution margins

• Projections for their future EBITDA

• The value and importance of Uber’s minority investments

A fascinating read in hindsight. Uber has finally achieved consistent profitability, and their ceiling is still debated.

If you’ve got ideas to improve the newsletter, we’d love to hear them! Let us know by replying directly to this email (plus it helps our deliverability!)

Thanks for being here.

— Written by Alex McClelland. Edited by Tom Alder.

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.