Read time: 3 minutes 45 seconds

Great products don’t start with a backlog - they start with outcomes.

And we’ve got the handbook, written by Jira Product Discovery’s Head of Product, to help you start. Learn how to:

Create the perfect product backlog, validated by feedback and insights

Frameworks to prioritise the highest impact ideas

Actionable tips used by the Jira Product Discovery team to go from idea to delivery

👉 Grab the free Product Discovery Handbook with 100+ tips and best practices

Why founders love Vanta

1,000+ YC-backed founders have scaled faster with Vanta

Vanta is one of the leading SMB Security Compliance on G2’s Grid Report

9/10 Startups recommend Vanta, based on our Average Net Promoter Score (NPS)

“If we’d done everything manually, it would have cost us up to AUD$100k in time and resources. Partnering with Vanta has cut that by more than half.” Anshul Jain, Co-Founder, Everlab.

By automating up to 90% of the work needed for SOC 2, ISO 27001, and more, Vanta has helped over 10,000 companies like Atlassian, Relevance AI and Everlab get compliant fast.

Thank you for supporting our sponsors, who keep this newsletter free.

Wednesday 21st May, 2025

This deal broke the internet today.

TLDR:

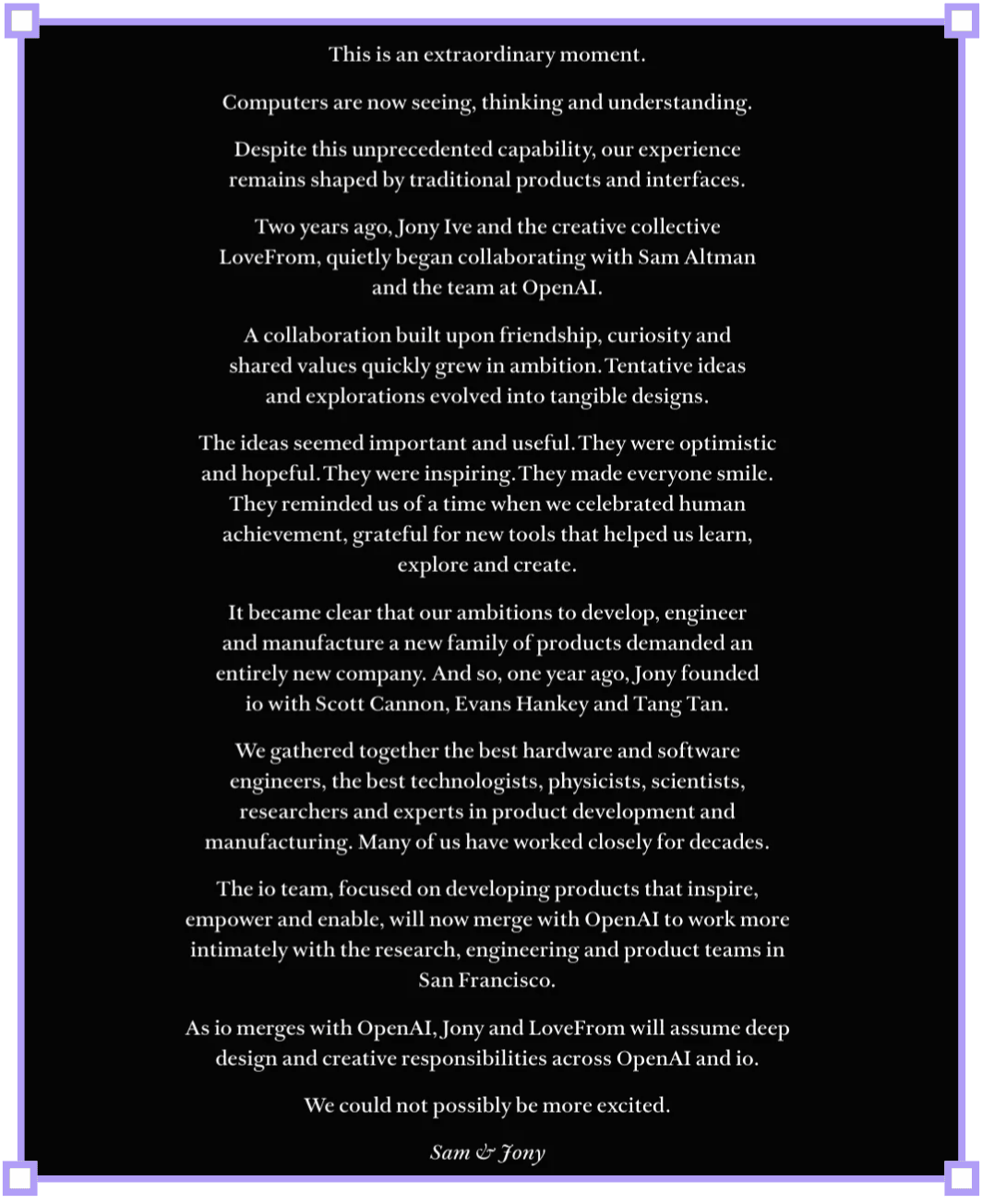

OpenAI is acquiring io - a 2yr old, pre-product, pre-revenue, 55-person startup led by Jony Ive

Jony is the most influential designer in tech history (led design of the iPhone, iOS, iPod, iPad, Apple Watch, and most likely whatever else you’re reading this email on)

Jony and Sam secretly co-founded io 2 years ago, imagining what a consumer device designed specifically for AI could be

Jony and his team will now lead all creative and design work at OpenAI

Here’s where it gets quirky: it’s an all-equity deal valuing io at $6.5 billion (or $118 million per employee - potentially the highest ever…?)

After about 2 hours of sniffing around X for memes and hot takes, I ended up tumbling down a rabbit hole of other frame-breaking acquisitions.

Not just the ones that generated the largest returns…

… but also the creativity behind the acquisition strategies shaping today’s most defining companies.

Like Slack - aggressively consolidating standalone apps for things like docs, screensharing, and employee directory into their core product, allowing them to rapidly shortcut their ‘feature gap’ with incumbents like Microsoft and Google.

Or Atlassian - buying, stacking, and combining a string of fast-growing collaboration tools (Bitbucket, Trello, Loom, etc) into one of the most efficient bundle / platform / cross-sell / PLG strategies in all of SaaS.

(Future breakdown ideas? 👀)

But the one that caught my monkey-brain in a Perplexity-loop for the rest of the day was Snapchat.

Snap Inc (Snapchat, Spectacles, Bitmoji, etc) could be the most underappreciated tech acquirer out there.

When you break it down, their entire business is an amalgamation of acquired startups.

→ Here are the 33 deals that shaped the Snapchat used by 900 million monthly active users today:

AddLive (2014) - $30m

Became Snapchats ‘Video Chat’ feature.Vergence Labs (2014) - $15m

Became ‘Spectacles’, Snapchat’s smart glasses hardware line.Scan.me (2014) - $50m

Became ‘Snapcodes’, Snapchat’s personalised QR code feature.Looksery (2015) - $150m

Became ‘Filters’ and ‘Lenses’, Snapchat’s facial recognition and modification technology.Bitstrips (2016) - $64.2m

Became ‘Bitmojis’, Snapchat’s personalised avatars.Obvious Engineering (2016) - Undisclosed amount

Became Snapchat’s ‘3D Selfies’, powering face swaps and other AR overlays.Vurb (2016) - $114.5m

Became Snapchat’s local business search and discovery features.Flite (2016) - Undisclosed amount

Became Snapchat’s interactive ad tech powering 360° video ads and vertical video ads.Cimagine (2016) - $30-40m

Became Snapchat’s AR product visualisation features.Ctrl Me Robotics (2017) - <$1m

Became part of Snapchat’s hardware team.Placed (2017) - $135m

Became Snapchat’s ad tracking for foot traffic and conversions in physical stores.Zenly (2017) - $213m

Became ‘Snap Map’, Snapchat’s interactive social maps.

(I wrote one of the first Strategy Breakdowns on Snap Map - read it here).Strong.Codes (2017) - Undisclosed amount

Became part of Snapchat’s code protection technology.Metamarkets (2017) - <$100m

Became Snapchat’s analytics dashboard for advertisers.PlayCanvas (2018) - Undisclosed amount

Became part of Snapchat’s ‘Lens Studio’, where developers build AR Lens effects.Teleport (2018) - $8m

Became part of Snapchat’s ‘Filters’ technology, powering features like hair colour changes.AIFactory (2020) - $166m

Became ‘Cameos’, Snapchat’s animated selfie video feature.Voca.ai (2020) - $70m

Became Snapchat’s Ai-based voice agents for customer support.Voisey (2020) - Undisclosed amount

Became Snapchat’s music creation and sharing features.Screenshop (2020) - Undisclosed amount

Became Snapchat’s product recommendations based on images saved to ‘Memories’.Ariel AI (2021) - Undisclosed amount

Became part of Snapchat’s AR experiences team.Fit Analytics (2021) - $124.4m

Became Snapchat’s virtual clothing try-on and sizing features.StreetCred (2021) - $124.4m

Became part of the location data platform powering Snap Map and other AR experiences.Demand Sage (2021) - Undisclosed amount

Became part of Snapchat’s ad reporting and analytics features.Pixel8earth (2021) - $7.6m

Became part of ‘Local Lenses’, Snapchat’s location-based AR experiences.WaveOptics (2021) - $500m

Became Snapchat’s AR display manufacturing team.Vertebrae (2021) - Undisclosed amount

Became Snapchat’s self-service system for brands to manage AR versions of their goods.Popwallet (2021) - Undisclosed amount

Became part of Snapchat’s mobile advertising network.NextMind (2022) - Undisclosed amount

Became part of ‘Snap Lab’, Snapchat’s AR hardware research team, working on brain-computer interfaces.Forma (2022) - Undisclosed amount

Became part of Snapchat’s virtual dressing featuresCompound Photonics (2022) - Undisclosed amount

Became part of Snap’s AR hardware R&D team, building microdisplays for Spectacles.

Th3rd (2023) - Undisclosed amount

Became part of ‘AR Enterprise Services’, creating Snapchat’s 3D digital product twins solution.GrAI Matter Labs (2023) - Undisclosed amount

Became Snapchat’s division for advanced AI/AR chip development for wearables (i.e. “Neuromorphic computing hardware”).

Wild.

I appreciate that for most of us (besides the 13% of you working in Corp Dev), we’re not exactly hunting for hardware startups to drop $500m on.

So I wanted to leave you with something to chew on (not just dream about chewing on).

Here’s my prediction:

→ AI agent acquisitions will become a defining strategy for internet businesses over the next 5 years.

SMBs, startups, scaleups, and enterprises alike.

I’m not talking about an agent that researches inbound leads and sends you a Slack summary of their LinkedIn activity (although they are pretty handy!)

I’m talking about acqui-hiring agent swarms.

Imagine using last month’s profits to acquire an entire Inbound SDR team:

Qualifying inbound leads using deep research and ICP template mapping

Nurturing leads with models fine-tuned on transcripts of the world’s most efficient salespeople

Scoring and prioritising based on semantic AI analysis of lead conversations

Handoff to other agent swarms for closing, delivery, customer success etc.

Logging and reporting for visibility and continuous orchestration optimisation

Fully out-of-the-box.

→ Spend 1 week configuring.

→ 2 weeks improving.

→ 1 week preparing for next month’s acquisition.

Things are about to get jazzy.

Bit of an experiment this week.

I wrote the entire email in 1 sitting.

Top-to-bottom.

OpenAI to Snapchat to agent swarms.

No constraints.

No thesis.

No edits.

Just a day’s worth of freeform observation + speculation, delivered straight from my browser history to your inbox.

What did you think? Y/N?

— Tom

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 80,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.