Read time: 3 minutes 2 seconds

Welcome to the 403 strategy nerds who have joined us over the last 2 weeks!

Join the growing community of 15,424 readers getting byte-sized strategy playbooks here:

Oh and if you’re interested in a behind-the-scenes look at how this newsletter is being built (stats, content, learnings), make sure to follow along on Twitter @tomaldertweets!

Now then, let’s get into today’s breakdown…

In 2022, Tesla raised the retail prices of their vehicles on 6 separate occasions.

In just the first 4 months of 2023, Tesla reversed the trend and slashed their prices 6 times.

Historically, in the system created by Henry Ford (now codified into law in most states), manufacturers lock in their prices for a full year every August.

So, how can Tesla change their prices so frequently, and what is the strategy behind the movements?

My Playbook to Discover Hidden Opportunities

StrategyHub gives you the exact system I used at Atlassian to make high-impact strategic decisions using free online data.

Become your company's go-to 'insights person' by spotting patterns and opportunities that others miss.

“We need a front-end developer by Tuesday, but it’ll take months to find someone in the US”

We use Athyna at Strategy Breakdowns – and a bunch of our friends do too. If you are looking for your next remote hire, Athyna has you covered. From sales to marketing, ops to engineering.

The secret weapon for ambitious startups. No search fees. No activation fees. Just incredible talent, matched with AI-precision, at lightning speed.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

Elon rejected the traditional franchised dealership model, where manufacturers had to lock in their recommended price, but independent dealers had the flexibility to negotiate the final sale price with the end customer.

He established a direct-to-consumer (DTC) business model that made Tesla both the manufacturer and the dealer, putting them in full control of the final price of their cars.

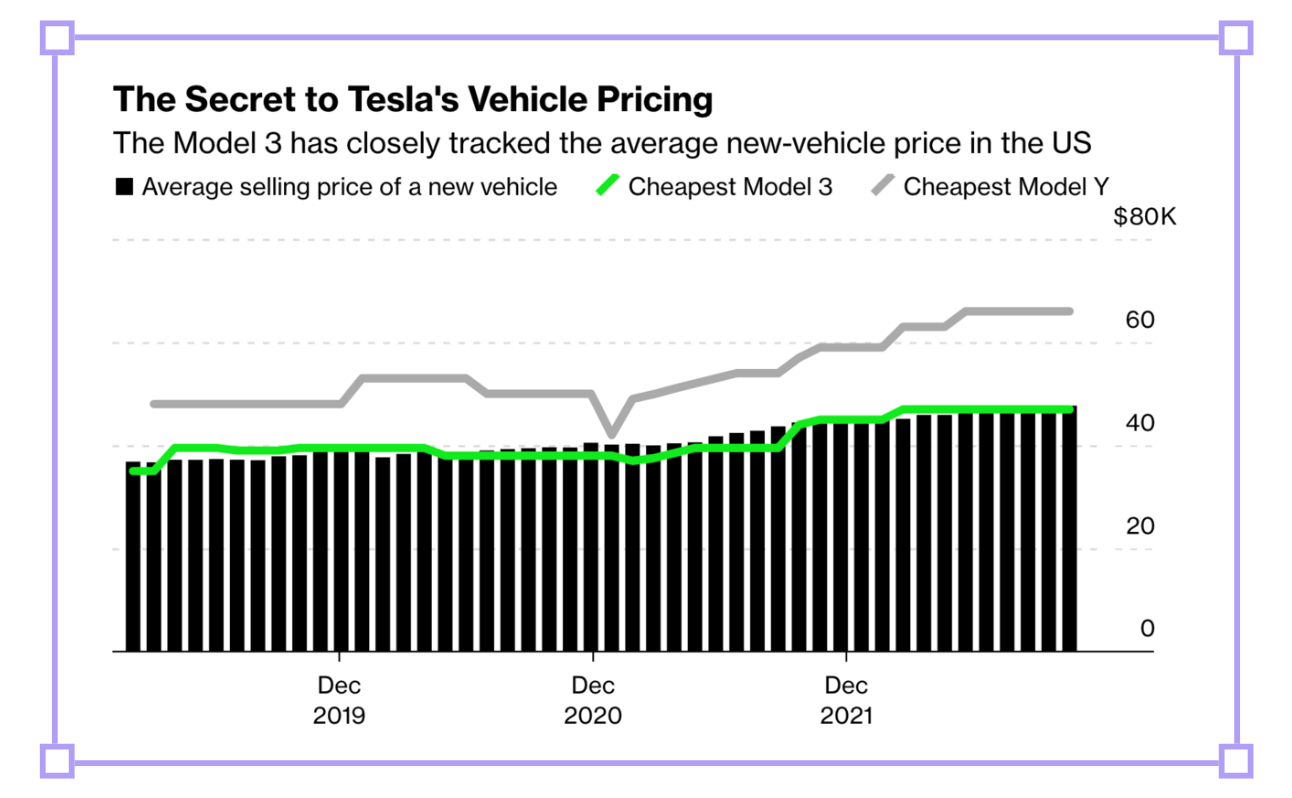

This allowed Tesla to price its vehicles dynamically based on market signal: their cheapest model consistently tracks the average price paid for a new vehicle in that market segment in the United States.

Market average when Model 3 was released: $34,944

Model 3 price: $35,000

Market average in Jan 2023: $47,692

Model 3 price in Jan 2023: $46,990

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Optimal entry price point

By tracking the market average price, Tesla ensures its cheapest vehicles are always positioned fairly in market.

Tesla started as a luxury brand with the Roadster, and used the high-ticket revenue to fund its expansion towards more economical vehicles.

Now their product catalogue has matured, their entry-level Model 3 sits at a perfect price point that is attractive to the average American, without leaving money on the table (at a lower price) or pricing out the critical customer segment (at a higher price).

Takeaway: Don’t guess your optimal price point for a high-volume product category - consider just using the average.

2. Customer perception

When Tesla first made surprise price changes, consumers were frustrated by the industry pattern interrupt. Tesla initially justified the changes on the basis of new features, performance upgrades, and deals.

As price changes continued, sometimes week to week, even without changes to the vehicles, customers became accustomed to them.

Now, the mere potential for change creates a psychological effect that motivates customers to make quicker purchasing decisions, fearing further increases.

Similar to volatile stock prices, Tesla’s cars are ‘probably better to buy today than tomorrow’.

Takeaway: Price sensitivity is important, but don’t underestimate how much consumer preferences can change.

3. Price elasticity of demand

Tesla recognised that locking in a price for a full year meant leaving money on the table if consumer willingness-to-pay rose.

On the other hand, it exposed them to supply chain risks if demand for their cars dropped.

When this happens, dynamic pricing lets Tesla respond by dropping prices to immediately stimulate demand.

When external factors like inflation, parts shortages, and new market entrants impact Tesla’s unit economics, they can instantly de-risk their operations and pass on the cost to customers.

Takeaway: Build in ways to respond to changes outside of your control.

One tweak to the traditional automotive business model → several competitive advantages.

Optimal entry pricing. Deeper market penetration. Market responsiveness. Economic agility.

Rabbit Hole

The where: 3x high-signal resources to learn more

[7 minute read]

@tsrandall from Bloomberg’s original analysis that first surfaced the novel pricing strategy.

Explores trickle-down effects like inflation response, EV waitlist dynamics, and Ford and Volvo moving in the same direction.

[3 minute read]

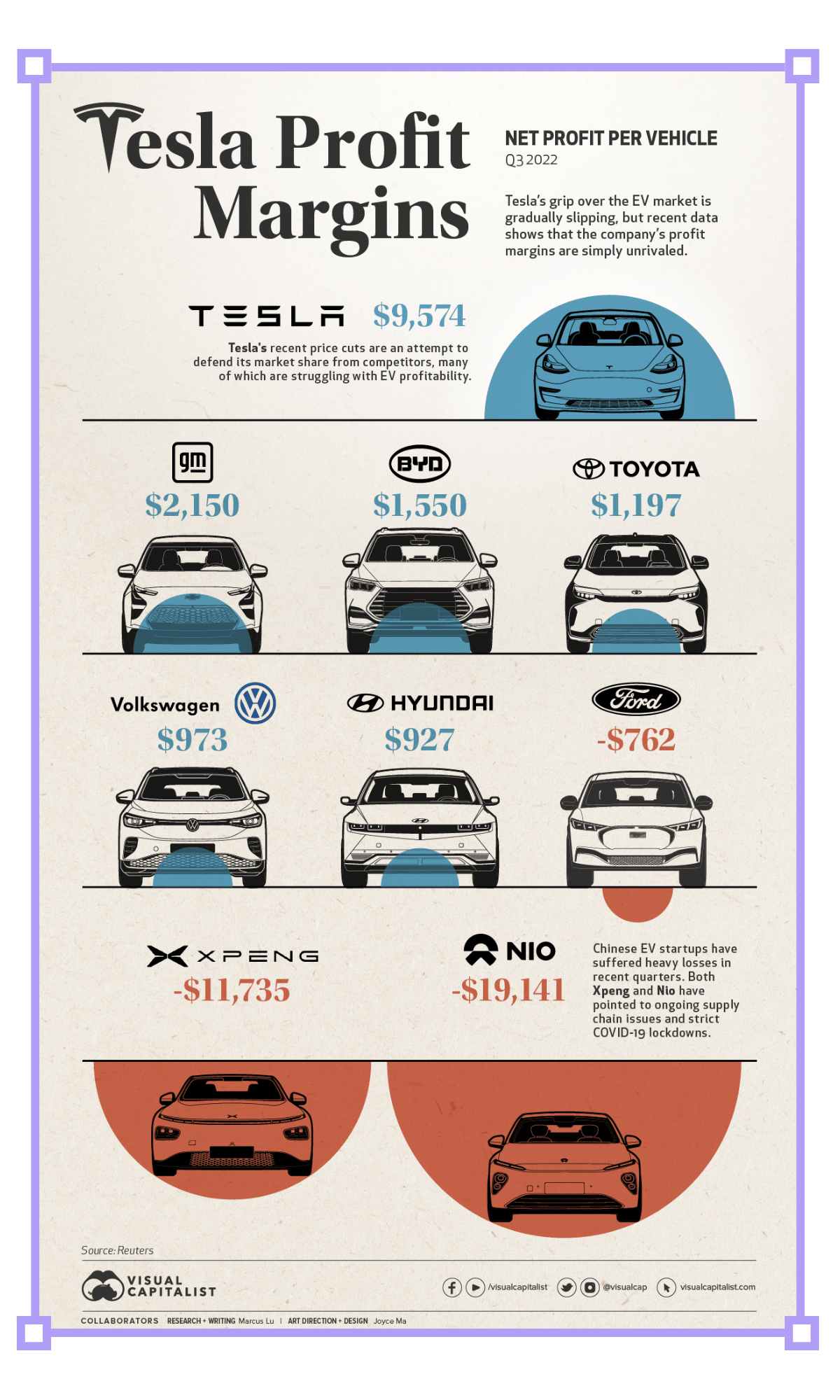

Despite facing rapidly growing competition, Tesla’s profit margins are 4-9x their nearest competitors like General Motors, BYD and Toyota.

Slashing prices is a risky but tactical move that hits back at other brands they know are struggling with EV profitability.

[5 minute watch]

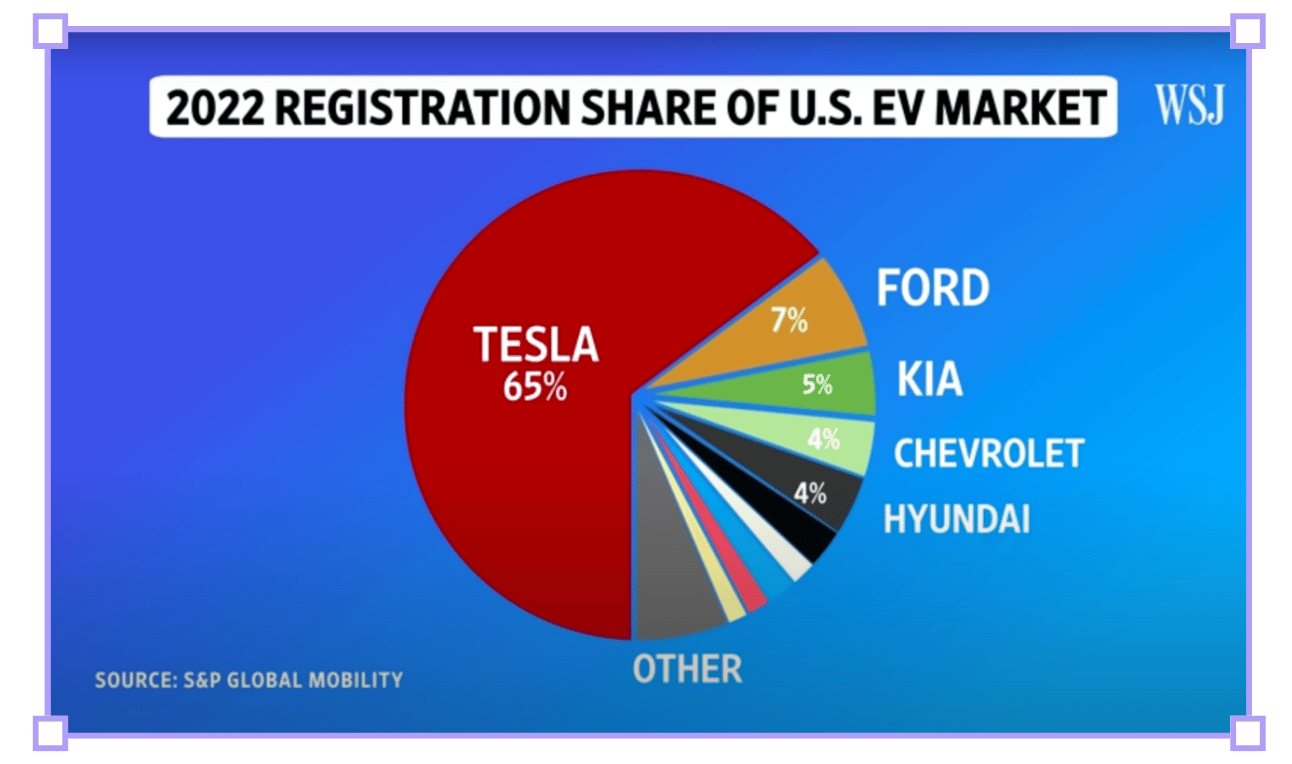

Wall Street Journal’s mini documentary on the battle currently playing out between Tesla and Ford.

Really plays into the analogy ‘business is like a slow-motion knife fight’.

‘Business is like a slow-motion knife fight’ is the perfect analogy for this competitive feud.

This competitive feud is a perfect example of the saying that ‘business is like a slow-motion knife fight’.

That's all for today’s issue, folks! Optimise your feeds by following on Twitter [@tomaldertweets] and LinkedIn [/in/tom-alder]

Got feedback? Any requests for the next breakdown?

Let us know by replying to this email!

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.