Read time: 3 minutes 50 seconds

Just recorded my first ever podcast interview. Hoping it makes for a nostalgic rewatch in 2, 5, 10 years from now.

Had fun jamming out with Dylan Redekop from SparkLoop on a few strategy / newsletter / growth topics like:

• How Strategy Breakdowns grew to 35k readers in 7 months

• 3x mental models that helped me leave my job to go ‘all-in’

• Full breakdown of current and future revenue streams

Watch it on YouTube or listen on Apple Podcasts and Spotify. Enjoy.

— Tom

Recommending Athyna is easy - Strategy Breakdowns is one of their happy customers.

Our first hire was an incredible Content Assistant from Argentina - next we'll be looking at outbound sales. End your mistakes in hiring today. Give Athyna a go.

The secret weapon for ambitious startups. No search fees. No activation fees. Just incredible talent, matched with AI-precision, at lightning speed.

“We need to turn this doc into a town-hall presentation by Tuesday”

You should try Tome — the smart, creative AI assistant that generates presentations and one-pagers. Tome 100X's your productivity.

Paste in a document

Watch AI generate a visual narrative

Tweak the output to suit your preferences

Try Tome today to see why it's the fastest ever productivity software to reach 1 million users.

Chess Move

The what: A TLDR explanation of the strategy

For the past half-decade, video streaming providers have engaged in an arms race to secure the best content for their subscribers. Premium content is an essential investment because it:

Attracts new subscribers to their platforms

Provides an appealing backdrop for potential advertisers

Justifies semi-regular price increases, driving up Customer Lifetime Value (CLV)

Reduces the risk of subscriber churn, which plagues even the strongest streamers

Founded in 2020, NBC’s flagship streaming platform Peacock trails its contemporaries like Disney+ and Netflix in key metrics like total subscribers and subscription duration.

They needed a catalyst for mass subscriber growth.

Cue in the National Football League.

America’s obsession with the NFL is self-evident. 93 of the top 100 TV broadcasts in the United States in 2023 were NFL games.

Peacock has been on a sports shopping spree the past few years, acquiring rights to popular events such as the PGA Tour, WWE, and the Premier League.

And they recently made their biggest purchase yet — an exclusive NFL playoff game for $110 million.

💡

Strategy Playbook: Partner with “sticky” brands on exclusive offerings that expose their customers to your products.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Follow the Leader

As viewers continue to pivot from broadcast and cable to streaming, the NFL is actively seeking opportunities to meet consumers where they are.

Their groundbreaking $10 billion partnership with Amazon Prime Video launched in 2022, marking the first time that NFL games were available exclusively through a subscription video on-demand (SVOD) service.

In a disruptive industry like SVOD, product launches are notoriously cumbersome and learning is very costly due to technical requirements and content fees.

Peacock piggy-backed on the pre-validated playbook established by Prime to expedite that process and reduce time spent experimenting.

2. A CAC cheat code

With more consumer choice than ever, Customer Acquisition Cost (CAC) is the core focus for teams competing in the streaming wars. In the last 12 months, Peacock has spent more than $1.6 billion on marketing and promotion — yet their 30 million subscribers leave a lot of room to grow.

Instead of launching a series of costly and time-intensive campaigns to attract new customers, Peacock found a moonshot opportunity to improve their CAC.

While critics scoffed at the lofty $110 million price tag, Peacock saw an opportunity to convert a fraction of the reported 23 million viewers of January’s Miami vs. Kansas City game to new Peacock subscribers.

It would have taken years of costly marketing campaigns, content acquisitions, and distribution partnerships to match the acquisition effects of a single NFL game. Plus, because of their consolidated investment, Peacock can now allocate those internal resources to other high-priority projects.

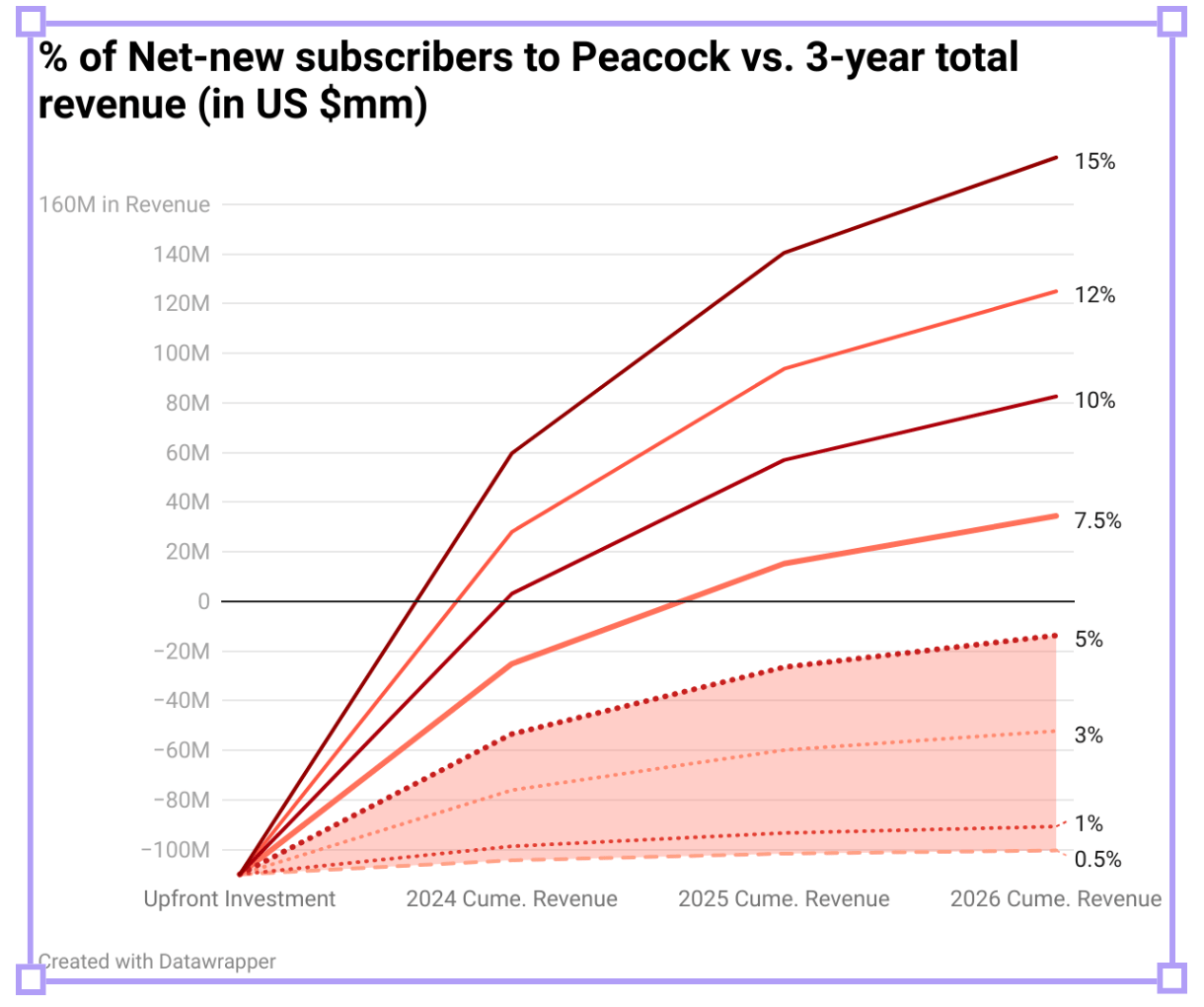

Assuming a constant $5.99/month subscription fee for Peacock, and a 6% monthly subscriber churn rate, Peacock would break even if about 6% of the game’s audience were retained as new customers.

Peacock easily cleared that hurdle rate, with analysts reporting the game drew 2.8 million new subscribers. This means over 12% of the game’s viewers were new to Peacock. Peacock’s CAC for this group is below $40, over 40% less than Netflix’s benchmark.

They are also poised to return as much as $235 million in subscription revenue over the next 3 years from this cohort.

Note: forecast presented in 2024 revenue, unadjusted for inflation, ignoring the present-value of money, and absent of any potential price increases that Peacock may introduce in the future.

3. Open up opportunities to increase customer lifetime value

Based on the assumptions made above, these new subscribers would have a CLV of around $84 dollars to Peacock.

Many e-commerce and SaaS businesses use the CLV:CAC ratio to help evaluate marketing decisions, aiming to achieve a ratio of 3x or more. Using the analyst estimate of 2.8 million new subscribers from the game, Peacock’s CLV:CAC ratio would be about 2.1.

But, subscriptions are not the only way that Peacock can drive revenue from this subscriber base. Other opportunities include:

Capitalizing on lucrative ad dollars that are pivoting away from traditional TV to streaming. Ads during NFL games can routinely fetch over $1 million, a figure that jumps to $3 million in the playoffs, and $7 million for the Super Bowl

Sharing customer data with product affiliates to run product placement during games, generating commission for Peacock, similar to what Amazon did during Black Friday

Share this valuable cluster of data back upstream with their content strategy and studio teams to help inform algorithms and future investment decisions

Rabbit Hole

The where: 3x high-signal resources to learn more

[5 minute read]

The NFL reigns supreme in the US, being some of the only content that can consistently attract massive live audiences.

In addition to the 93 NFL broadcasts, College football claimed 3 of the top 100, and the Super Bowl “lead out” also grabbed a spot, meaning football-adjacent programing accounted for a massive 97/100 in 2023.

This is up from the NFL’s share of 72/100 in 2020.

[12 minute read]

Technologies like SVOD, short-form video, and AI have entirely upended the advertising industry. A few areas that industry analysts are watching:

• The pace which streaming ads will overtake traditional TV ads

• How companies manage their media dollars amidst economic uncertainty

• How AI will impact the day-to-day approach for advertisers

[20 minute listen]

Joe Pompliano from HuddleUp explores why the NFL was willing to move a game exclusively to a subscription-based streaming service, and why Peacock was willing to shell over 9-figures for this opportunity.

Hint: It’s not just a loss leader.

That’s all for today’s issue!

Any feedback on today’s edition? Send us a reply!

Thanks for being here.

— Tom Alder and Alex McClelland

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.