Read time: 4 minutes 3 seconds

Every strategy article you've ever read ( and I’ve ever written) makes the same assumption:

Companies exist to maximise shareholder value.

Growth strategies, viral loops, pricing tactics - they're all optimising for the same endpoint.

→ More users, higher revenue, faster growth, higher LTV… = more shareholder value created.

We analyse the how whilst taking the why as a given.

But what happens when a company rejects "maximise value", instead seeking only to "maximise planetary impact"?

Today's breakdown dissects Patagonia’s $3 billion experiment that rewrote the rules of purpose-led business.

Enjoy.

— Tom

Unlock the Power of AI Teammates

Discover how AI teammates are transforming productivity for teams. This quick-read from Atlassian reveals actionable strategies to automate workflows, speed up delivery, accelerate decision-making, and ensure your team stays future-ready.

Why founders love Vanta

1,000+ YC-backed founders have scaled faster with Vanta

Vanta is one of the leading SMB Security Compliance on G2’s Grid Report

9/10 Startups recommend Vanta, based on our Net Promoter Score

“If we’d done everything manually, it would have cost us up to AUD$100k in time and resources. Partnering with Vanta has cut that by more than half.” — Anshul Jain, Co-Founder, Everlab.

By automating up to 90% of the work needed for SOC 2, ISO 27001, and more, Vanta has helped over 10,000 companies like Atlassian, Relevance AI and Everlab get compliant fast.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

The succession dilemma of the successful private founder:

Sell the company (and lose control of the mission), or

Go public (and surrender to quarterly earnings pressure)

Yvon Chouinard, founder of outdoor gear company Patagonia, created his own exit plan to uphold his company’s original mission (“We’re in business to save our home planet”) in perpetuity.

“Truth be told, there were no good options available. So we created our own.”

In September 2022, rather than going “public," Patagonia went "purpose".

The 84-year-old founder transferred 100% ownership of his $3 billion company to a novel corporate structure that ensured company profits would be legally required to be used for environmental causes forever.

Patagonia’s voting stock (2% of all stock) went to the Patagonia Purpose Trust: a permanent legal structure ensuring mission continuity beyond the founder’s lifetime, whilst eliminating personal wealth extraction by successors.

The remaining 98% of Patagonia went to the Holdfast Collective: a nonprofit that receives all of Patagonia’s profits (estimated $100 million annually) indefinitely, with the sole purpose of using them to protect nature.

In other words, Patagonia itself remains a for-profit company, but the trust protects the company’s values, while the profits flow into an environmental non-profit.

"Instead of extracting value from nature and transforming it into wealth, we are using the wealth Patagonia creates to protect the source… We're making Earth our only shareholder. I am dead serious about saving this planet."

💡

Strategy Playbook: Make your values structurally inevitable, not dependent on management discretion.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Engineered mission permanence

Patagonia's dual-entity ownership structure is designed to address the fundamental weakness of traditional corporate environmental commitments:

→ They're discretionary.

Here’s how the Patagonia structure works:

The Patagonia Purpose Trust holds all voting stock (2% of total stock), and exists as “a permanent legal structure to enshrine Patagonia’s purpose and values”.

It is controlled by the Chouinard family and close advisors, and has an independent ‘Protector’ in place to monitor the trust’s fidelity to purpose.

It has the power to elect and remove board members, and even remove the CEO if needed, to keep the company mission-aligned.

Importantly, the trust cannot sell its Patagonia shares, and it has no economic beneficiaries, so even if a future family member went rogue, they wouldn’t be able to profit personally from the Trust’s share allocation.

The trust is purely architected solely to guard Patagonia’s soul.

The Holdfast Collective is a new non-profit entity that owns the other 98% of Patagonia’s stock (all the non-voting equity).

Under the restructuring, “every dollar that is not reinvested back into Patagonia will be distributed as dividends to [the] Holdfast Collective to help fight the climate crisis.”

The nonprofit's 501(c)(4) status was strategically chosen to enable not just charitable funding, but also unlimited political lobbying and advocacy - capabilities that traditional 501(c)(3) charities cannot access.

The Collective’s share allocation channels an estimated $100 million annually in perpetuity toward systemic environmental protection, with Holdfast legally dedicated to protecting nature, biodiversity, and supporting thriving communities.

In its first year alone, the Collective made 690 grants and commitments exceeding $61 million, helping protect 162,710 acres of wilderness globally.

Every Patagonia sale directly funds environmental protection.

Unlike companies that simply make promises (which management can change) to donate profits, Patagonia is legally required to do so by the ownership structure itself.

"Under pressure, every single business gravitates toward profits. So [purpose and profits] have to be entirely connected, or you have to call it what it is."

Environmental commitment isn't an afterthought to the business model - it is the business model.

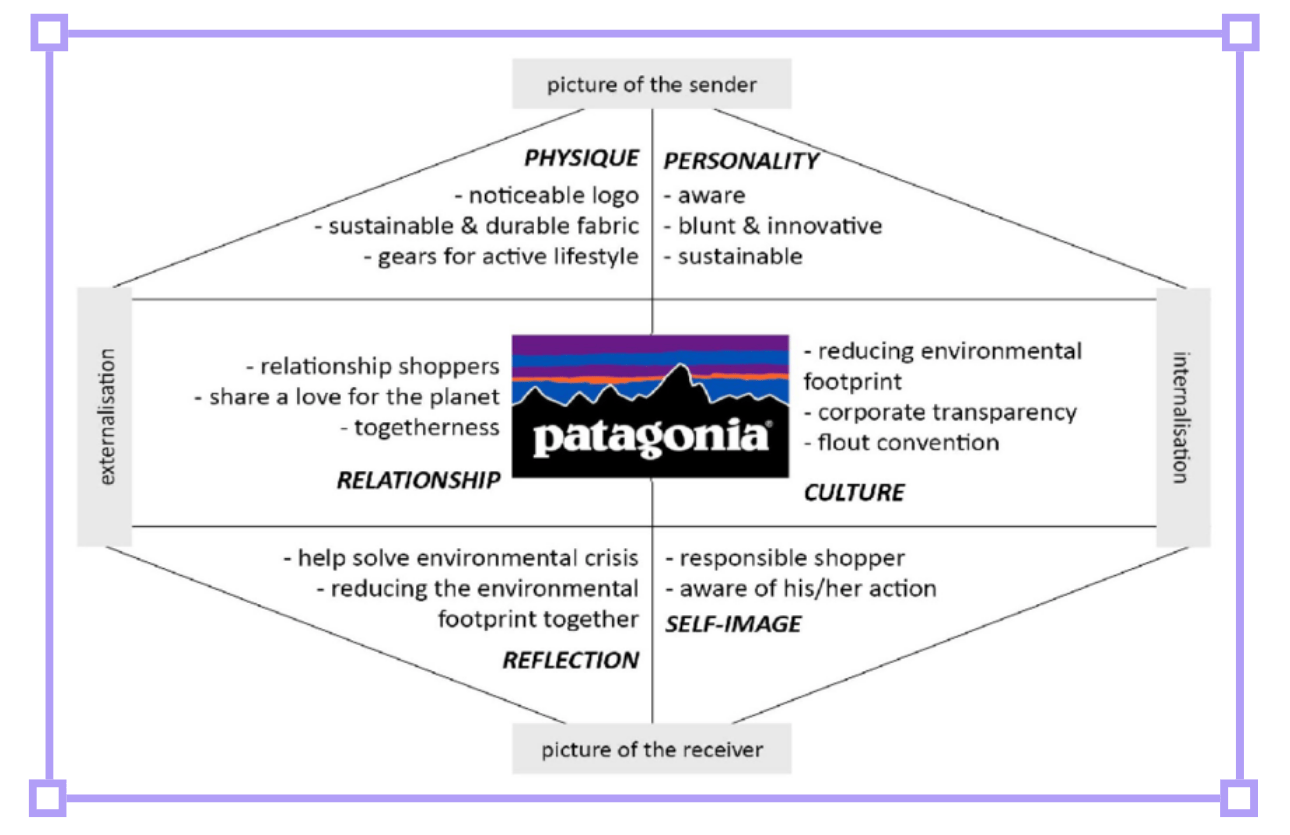

2. Unassailable competitive differentiation

Whilst competitors like The North Face, Columbia Sportswear, and Arc'teryx remain victims to quarterly earnings pressures, Patagonia operates with a unique type of freedom.

"Companies that create the next model of capitalism through deep commitment to purpose will attract more investment, better employees, and deeper customer loyalty."

Named America's most reputable company in 2023, Patagonia’s authenticity premium over competitors allows them to generate higher margins through pricing that purpose-driven consumers willingly pay.

Image via Round

With 86% of products incorporating preferred materials and 90%+ manufacturing occurring in Fair Trade Certified factories, the company's authentic environmental credibility (built over 50 years and now structurally guaranteed) justifies premium positioning.

"Anybody who wants to buy a jacket is going to think, 'Wow, I can buy a jacket and all of the profit is going to a cause I care about.'"

Despite operating in a market overwhelming characterised by environmental commitments, Patagonia sits is a category of 1:

The only outdoor gear company with total alignment between business model and mission.

(a.k.a. The only ‘legit’ one.)

3. Strategic conditions for mission-locked ownership models

Patagonia's radical restructuring unfortunately isn't universally applicable.

It works best for profitable, privately-held companies with founders seeking purpose-aligned succession solutions, even at the expense of personal / family wealth.

(Spoiler: it’s a short list).

Comparing Patagonia's approach to other mission-driven ownership models reveals the strategic conditions required for success:

Dr. Bronner's is the textbook approach to values-driven business.

The organic soap company (family-run since 1948) maintains its "All-One" social mission through self-imposed limitations: capping executive pay at 5x the lowest worker's salary and donating roughly one-third of profits to charity and activism annually.

GQ called it "the last corporation with a soul" and likened Dr. Bronner's to Patagonia as "similar in scale and ethical ambition."

The critical difference: Dr. Bronner's still relies on active family leadership to stay the course. Patagonia's trust structure guarantees mission continuity past the founding family's lifetime, eliminating the risk of future generations abandoning founding principles.

Robert Bosch GmbH is the European precedent for transferring ownership to a foundation.

The German engineering giant has operated for decades with 92% ownership by a charitable foundation (Robert Bosch Stiftung), ensuring profits fund charitable work in science, education, and society.

This model proves foundation ownership can work at massive scale - Bosch generates over €90 billion in annual revenue (compared to Patagonia’s ~$1.5 billion).

The critical difference: Like Dr Bronner’s, Bosch lacks the trust structure that ensures the company’s commercial operations serve the mission outcomes (as opposed to just funding them as an afterthought).

Ben & Jerry's is an unfortunate anti-example - demonstrating the fragility of mission protection without structural safeguards.

When acquired by Unilever, the ice cream company established an independent "social mission board" to preserve its values.

However, conflicts arose between the acquirer’s commercial pressures and Ben & Jerry’s social mission (B&J sues Unilever, co-founder Jerry Greenfield left the company 7 days ago as of time of writing).

The critical difference: Patagonia's dual-entity structure avoids this kind of ‘mission drift’ by maintaining complete independence from external corporate owners.

The reality is, "few companies of Patagonia's size remain owned by a single family, aligned in their values and not answerable to external investors." (Business of Fashion)

The Patagonia model requires not just wealth, but philosophical alignment across family members and the founder's willingness to permanently surrender financial control.

But for the right mission-driven companies with the right conditions for aligning commercial success with perpetual impact at scale → Patagonia provides the new template.

Rabbit Hole

The where: 3x high-signal resources to learn more

[2 minute read]

The original announcement that broke the internet.

Yvon Chouinard's own words explaining why he gave away his $3 billion company.

His brutal assessment of every exit option ("disaster scenarios"), why he chose Earth as his successor, and the personal philosophy that drove the most unconventional ownership transfer in business history.

[4 minute read]

$50 million committed across 10 countries through the Holdfast Collective

$200 million+ donated through 1% for the Planet since inception

One radical ownership model that "permanently connects financial value to values"

The outdoor gear company's CEO on why they're redefining quality as an environmental issue, and how they plan to make consumers "need fewer things and keep them in use for longer”.

[3 minute read]

Patagonia’s legendary Black Friday gambit: “Don’t buy this jacket”.

Step 1: Spend big money with The New York Times to anti-advertise your own product

Step 2: Leverage counterintuitive psychology to make "buy less" more persuasive than “buy this”

Step 3: Become a symbol for the anti-consumerism movement in retail

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 90,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.