Read time: 8 minutes 10 seconds

A few days shy of 12 months ago, I made a LinkedIn post about something odd in the footnotes of tech history.

A peculiar 1997 deal between Microsoft and Apple that seemed to lay the groundwork for the next 20+ years of dominance for both companies.

Dreaming of 300k views when I drop this, too.

The post blew up, but something about it always nagged at me. The public story felt too… neat.

Last weekend, I finally pulled on that thread - I spent 8+ hours digging through court documents, leaked internal emails, biography interviews, reconstructing what actually happened.

Turns out the real story is way juicier than I originally thought.

Enjoy.

— Tom

Stop wasting hours on manual digital marketing

Most marketers drown in keyword lists, content gaps, and endless audits. What if AI could handle the grunt work while you focus on the big picture?

With Ahrefs AI, every part of your marketing - research, writing, brand tracking, and even localisation - runs on autopilot.

Reclaim your creativity and scale smarter.

Profit is now the product

This year’s State of Product report shows a major shift: profitability is the top focus for product teams - but only 12% say they find the focus on profit motivating.

Nearly half lack time for strategy, roadmapping, or data analysis. The result? Teams are stuck reacting instead of shaping the business.

Learn what sets top performers apart - and how early collaboration with engineering changes the game.

Why profitability is reshaping product priorities

What high-performing teams do differently

How early alignment with engineering drives better outcomes

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

In August 1997, Bill Gates's face appeared on a massive screen at Macworld Boston, looming over thousands of diehard Apple fans.

The astonished audience booed. Jobs later called it "my worst and stupidest staging mistake of my life."

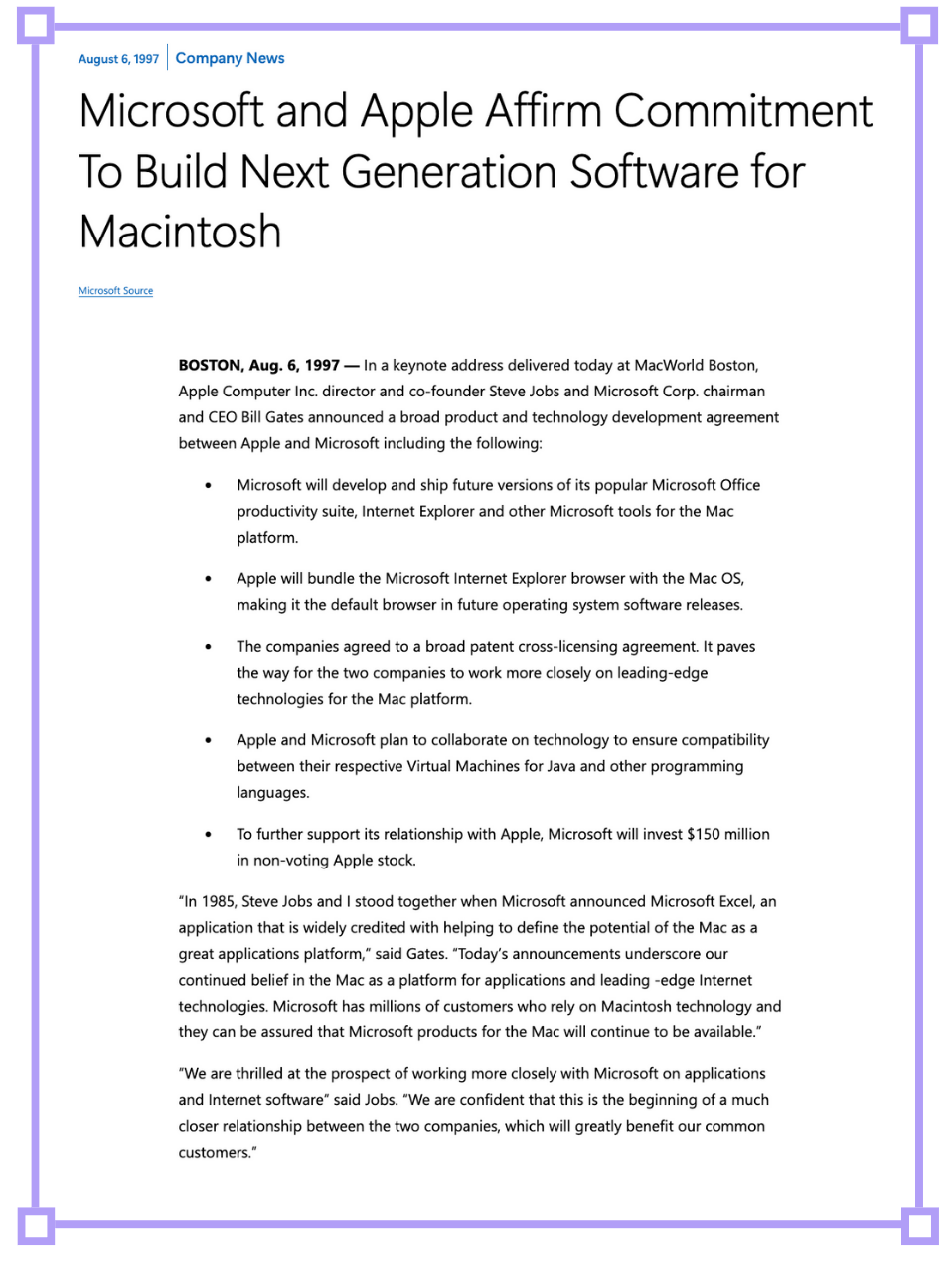

The announcement seemed straightforward on paper: Microsoft would invest $150 million in Apple, commit to shipping Office for Mac for five years, and the two companies would settle their patent disputes.

Tech headlines proclaimed Microsoft had saved Apple from bankruptcy.

… Except that's not quite what happened.

Behind the theatrics was one of tech history’s most consequential negotiations.

Apple was losing $1 billion annually, with “less than 90 days of cash left”, but they weren't negotiating from weakness.

They had cornered Microsoft with multiple patent lawsuits that would have cost billions. The $150 million investment that dominated headlines was camouflage for a much larger settlement - Microsoft ultimately paying between $500 million to $2 billion in licensing fees over several years (though this was never disclosed publicly).

The public deal included a complex web of commitments: patent cross-licensing, guaranteed Microsoft Office development for Mac, Internet Explorer as the default Mac browser, Java compatibility, on top of the lawsuit settlements.

The invisible strategic backdrop was that Microsoft needed Apple alive, not dead. A complete Apple collapse would trigger DOJ antitrust action against Microsoft's dominating desktop OS market share.

The irony of it all: Microsoft kept Apple alive to avoid antitrust issues, but regulators came for them a year later anyway. Apple used that lifeline to create the iMac, which doubled their desktop market share from 5% → 10%, and ultimately the iPhone, which won mobile computing and powered Apple’s ascent to becoming the worlds most valuable company.

This could be tech’s most fascinating deal. Let’s break it down.

Breakdown

The why: The deal that defined the next 20 years

1. The Context

The Microsoft deal was Jobs's first major move after a dramatic summer.

Jobs had been ousted from Apple in 1985 and went on to co-found NeXT. In February 1997, Apple CEO Gil Amelio acquired NeXT for roughly $430 million, bringing Jobs back as an advisor.

Despite the acquisition, Jobs had no faith in Amelio's ability to turn Apple around. In June 1997, he sold 1.5 million shares of Apple for $22.5 million, which spooked the market and tanked Apple's stock to a 12-year low.

Over the following week, Jobs convinced Apple's board to find a new CEO. Amelio resigned and Jobs became interim CEO.

His first strategic priority: leverage the legal standoff with Microsoft to remedy Apple's dire financial state - $1.5 billion in losses over the prior 18 months and less than 5% of the PC market.

Jobs famously called up Gates and said “Microsoft and Apple should work more closely together, but we have this issue to resolve… Let’s resolve it… Don't worry about that negotiation with Gil Amelio. You can just talk to me now.”

He came into the negotiation armed with 4 sources of leverage that ended up securing Apple their lifeline.

Leverage point 1: The QuickTime patent lawsuit

Between 1994-1995, Apple had sued Microsoft, Intel, and San Francisco Canyon Company after discovering that "several thousand lines" of QuickTime code were stolen and built into Video for Windows.

San Francisco Canyon Company (who Apple had contracted in 1992 to port QuickTime to Windows) was later hired by Intel and Microsoft, and shared Apple's code with them. By 1997, Apple had documentation proving the theft, court injunctions already issued, and a likely path to multi-billion dollar damages.

Leverage point 2: The look-and-feel GUI lawsuit

In this decade-long battle, Apple claimed that Microsoft had copied elements of the Mac GUI in Windows, beyond the licensing terms. Whilst Microsoft had mostly won this copyright case at lower courts, Apple had kept it alive on appeal since 1988, creating ongoing legal costs, public perception issues, and general uncertainty.

Leverage point 3: Microsoft's Office dependency

Microsoft had 8 million highly profitable Mac Office customers who would partially vanish if Apple died. Mac users tended to be in education, creative industries, and small businesses - premium customer segments willing to pay full retail prices.

Leverage point 4: Microsoft's antitrust vulnerability

Microsoft controlled roughly 95% of desktop operating systems in 1997, with Apple owning the remainder. A complete Apple collapse would almost certainly trigger immediate DOJ action to break up Microsoft as the only player a huge and rapidly growing market. Keeping Apple viable (but weak enough not to threaten Windows) gave Microsoft a defence against monopoly claims.

The negotiation wasn't just about Microsoft saving Apple. It was about finding terms where both companies could move forward without destroying each other.

2. The Deal

The conventional story goes like this: Microsoft saved Apple from bankruptcy with a $150 million investment in 1997, proving even bitter rivals can become unlikely saviours.

The actual deal terms went far beyond the $150 million investment that grabbed headlines - with five five distinct components, each strategically significant:

Component 1: The equity investment

$150 million for 150,000 shares of non-voting preferred stock

Microsoft agreed to hold for at least three years

Represented approximately 5-7% of Apple's equity at the time

Non-voting structure prevented Microsoft from influencing Apple's direction

Apple got capital and credibility (a Microsoft investment signalled confidence) without ceding control. Microsoft got equity upside and antitrust cover without the regulatory scrutiny that voting shares would trigger.

Microsoft ended up selling the entire stake in 2003 for $550 million - a 260% return over six years. If held until 2025, the stake would be worth approximately $184 billion after stock splits and dilution.

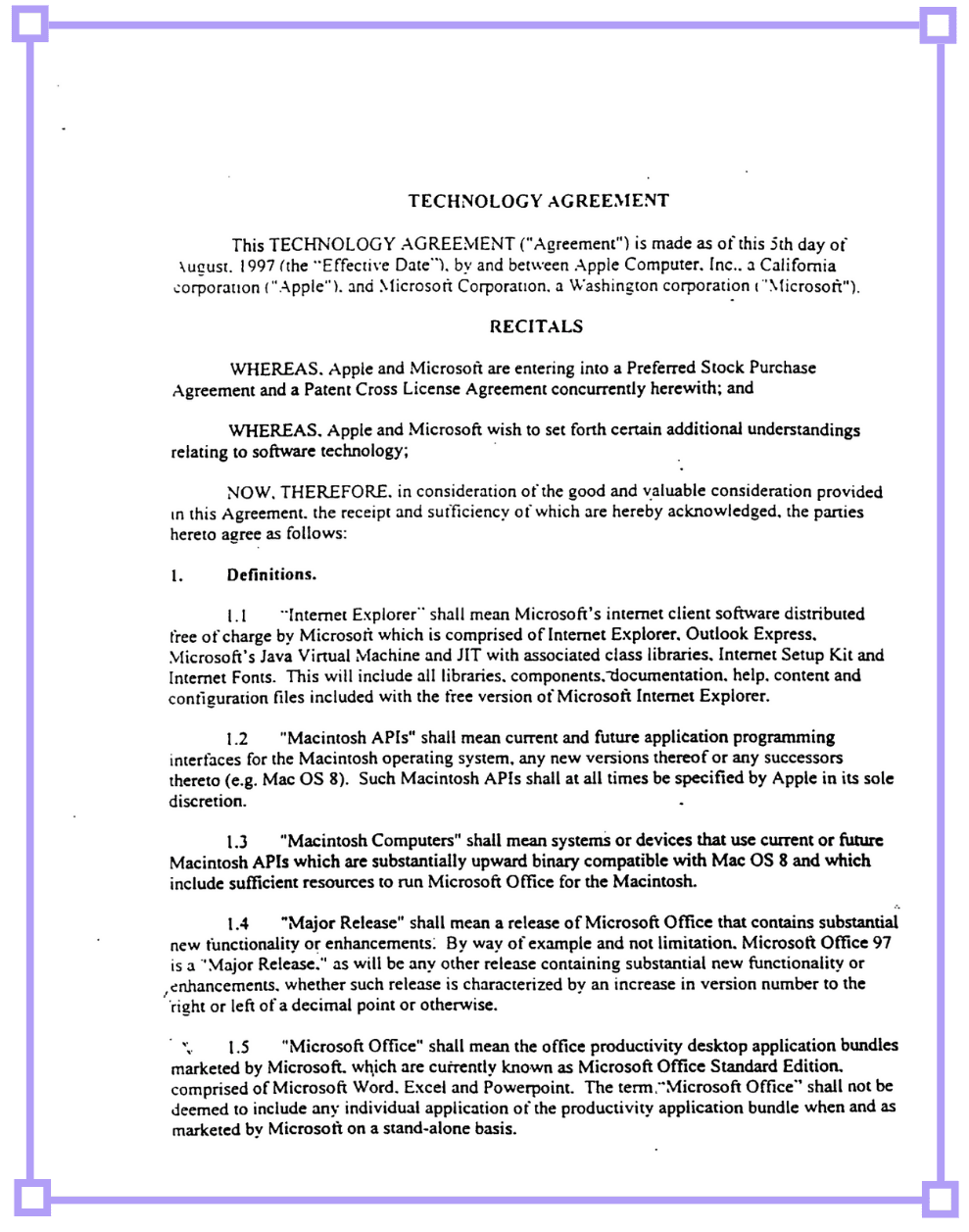

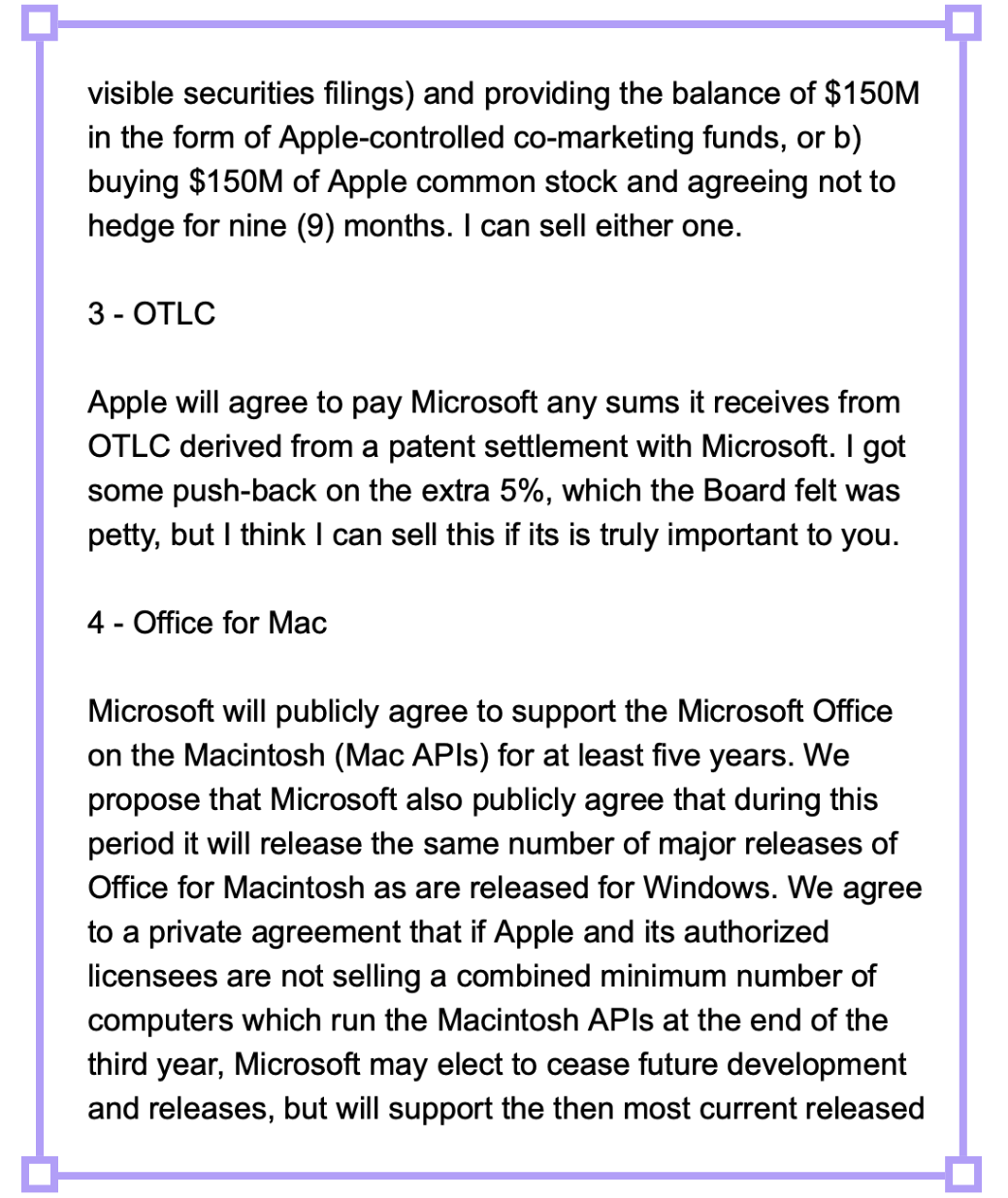

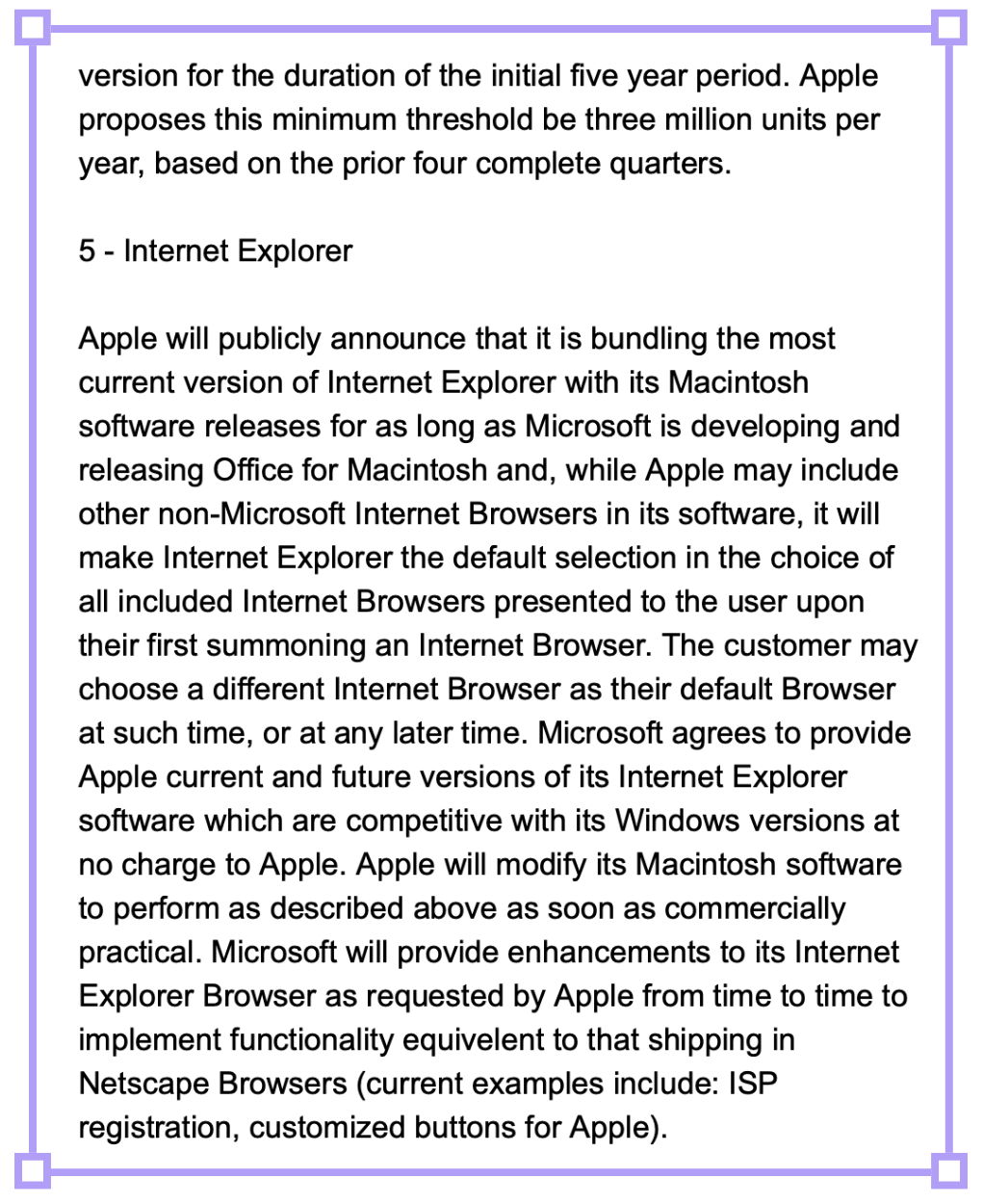

Component 2: Patent cross-licensing

Broad cross-licensing covering ALL existing patents from both companies

Extended to patents obtained during the subsequent five years

Worldwide coverage for both utility patents (technical features) and design patents (aesthetic elements)

Anti-cloning provisions prevented direct product copying

This eliminated the mutual legal threat - Apple no longer had grounds for its multi-billion dollar QuickTime lawsuit, so Microsoft avoided massive damages. Both could now innovate without fear of patent warfare.

It also created a duopoly moat. Any new desktop OS entrant would face patent challenges from both giants, effectively locking out future competition whilst allowing Apple and Microsoft to compete freely with each other.

Component 3: Software commitments

Microsoft Office for Mac guaranteed for five years with "same number of major releases as Windows version"

Internet Explorer as default (but not exclusive) Mac browser for five years

Java Virtual Machine compatibility collaboration

Continued development of "leading-edge technologies for Mac platform"

Office for Mac was a solid revenue stream for Microsoft, but for Apple, Office was existential. Office for Mac provided 32.1% of Apple's "home" market revenue in 1995. Without it, Apple couldn't credibly serve business customers. Microsoft Office "singlehandedly kept the Mac a credible platform for classic productivity apps" (source) until Apple shipped iWork in 2005.

For Microsoft, the IE requirement was about browser wars with Netscape. Making IE the default Mac browser extended Microsoft's reach whilst appearing to support cross-platform standards.

The IE provision later came back to haunt Microsoft. During the 1998 antitrust trial, DOJ prosecutors specifically cited this as anticompetitive: "Microsoft, by threatening to cease development of its Office for Macintosh productivity suite, coerced Apple into making Internet Explorer the default browser on all Macintosh operating systems."

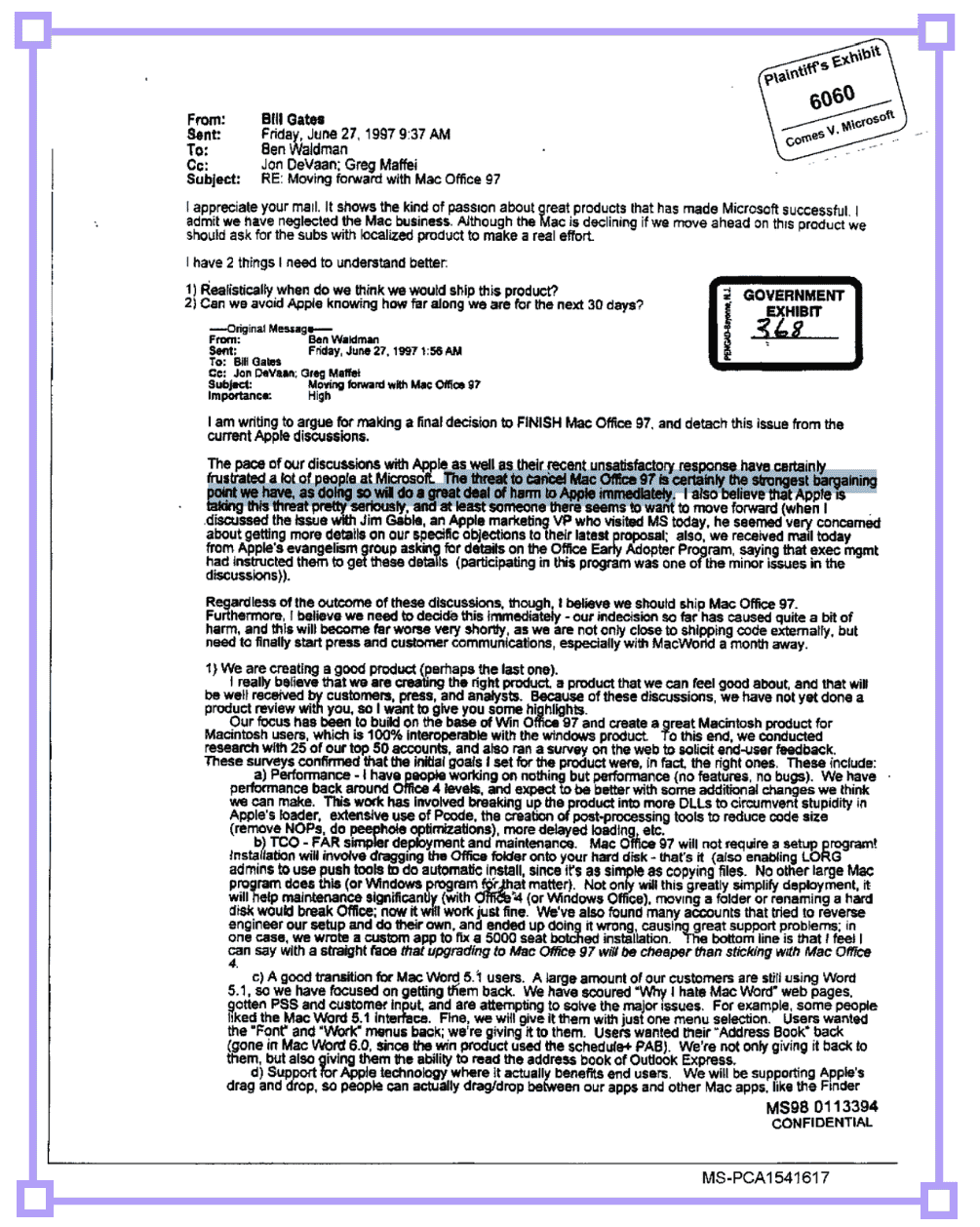

"The threat to cancel Mac Office 97 is certainly the strongest bargaining point we have, as doing so will do a great deal of harm to Apple immediately." (VP Ben Waldman to Gates, leaked 1997 internal Microsoft email).

Component 4: Lawsuit settlements

Dropped the decade-long "Look and Feel" GUI copyright lawsuit

Settled the QuickTime code theft lawsuit with undisclosed payments

All "lingering issues" from both cases resolved

These settlements removed massive legal liabilities for both parties. Microsoft avoided potential billions in damages. Apple got cash (quietly) and could focus on products rather than litigation.

Component 5: Collaborative development

Joint work on Java programming compatibility

QuickTime streaming technology collaboration

Cross-platform development tool improvements

Commitment to ongoing collaborative developments made both platforms stronger. It also signalled to developers that Mac and Windows would remain compatible in some ways, reducing the risk of developing for both platforms.

Original press release for the deal kept both companies intact, and enabled them to dominate their respective markets through the 2000s.

3. The Aftermath

Standing before a booing crowd, Jobs announced the deal.

He had the impossible task of selling it to an audience that saw Microsoft as the enemy.

Microsoft announcement starts at 26:12

The famous line that calmed the audience: "We have to let go of this notion that for Apple to win Microsoft has to lose. OK? We have to embrace a notion that for Apple to win Apple has to do a really good job, and if others are going to help us, that's great, because we need all the help we can get."

On Microsoft Office: "I think, if we want Microsoft Office on the Mac, we better treat the company that puts it out with a little bit of gratitude. We like their software. So, the era of setting this up as a competition between Apple and Microsoft is over as far as I'm concerned."

On the market reality: "Apple plus Microsoft equals 100% of the desktop computer market. And so, whatever Apple and Microsoft agree to do, it's a standard."

His objective was redefining success. Apple didn't need to beat Microsoft in operating system market share. They needed to survive, recover and find their own path to excellence.

The immediate impact for Apple:

6 August 1997: Apple stock jumped 35% on announcement

Apple stabilised financially and quickly began recruiting top talent

In 1998, Apple launched the colourful iMac G3, selling 800,000 units in the first five months

The company soon returned to profitability

The long-term divergence:

For Apple, the breathing room was transformative:

Focus shifted from competing with Windows to creating new product categories, with iPod (2001), iPhone (2007), iPad (2010) establishing entirely new markets

In 2010, Apple surpassed Microsoft in market cap for the first time since the 90’s

By 2011, Apple became the world's most valuable company

Today, Apple is worth roughly $3.5 trillion - the second most valuable company (after NVIDIA)

For Microsoft, the success of the deal was more complicated:

Sold their Apple stake in 2003 for $550 million, leaving approximately $183.5 billion on the table - in his 2025 memoir "Source Code", Gates wrote: "I wish we'd maintained that 5% ownership. It was foolish, foolish to sell it, but when we're worrying about all sorts of antitrust things, we sold it for what now looks like nothing"

Maintained desktop dominance but missed mobile computing entirely, with Windows Phone failing to gain meaningful traction - Gates admitted in 2019, missing the mobile market and losing to iPhone & Android was his "greatest mistake"

Today, Microsoft is worth roughly $3.1 trillion - the third most valuable company in the world

The competitors who almost intervened:

Oracle CEO Larry Ellison publicly announced on 27 March 1997 that he was considering raising $1 billion to acquire 60% of Apple's stock, "My idea was simple, buy Apple, and immediately make Steve CEO. Apple wasn't worth much back then, about $5 billion dollars.”

Sun Microsystems had talked about merging with Apple multiple times throughout the 1990s but never closed a deal.

Michael Dell delivered his infamous prediction in 1997 when asked what he'd do if he ran Apple: "What would I do? I'd shut it down and give the money back to the shareholders."

The legacy:

The 1997 cross-licensing agreement continues to prevent major IP litigation between them. Notably, Apple's later "thermonuclear war" against Android over patent infringement never extended to Microsoft - the 1997 deal protected both parties.

Without the deal, we could be sitting here with with no iPhones, no Macbooks, no Apple, and an unbundled Microsoft broken up into separate companies for Windows and applications like Office.

Plan for this weekend: come up with the best counterfactual “What if” hypothetical for if this deal never happened.

Hope you enjoyed today’s breakdown.

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 100,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.