Read time: 3 minutes 41 seconds

ICYMI, over the weekend we shipped a side-project for the ‘build-in-public’ enthusiasts:

A complete view of our entire tech stack.

36* tools we’re currently using to power the Strategy Breakdowns newsletter, website, and team (plus a description of exactly how we’re using each one).

Click here to unlock access to the Strategy Breakdowns Tech Stack (it’s free).’

– Tom

* 37 once we start using JPD to automagically prioritise our roadmap

There’s a world where your CRM is powerful, easily configured, and deeply intuitive.

Attio makes that a reality.

Attio is a radically new CRM built specifically for the new era of companies. It’s flexible, easily configures to your unique data structures, and works for any go-to-market motion from self-serve to sales-led.

The next era of companies deserves a better CRM.

Loved by ElevenLabs, Replicate, Modal and more.

“Jira Product Discovery translated our entire process into a highly transparent workflow, connected to the work we were already doing in Jira. That was a mind-blowing moment."

— CPO, Doodle

Make prioritization painless. Reimagine your roadmapping process. Try Jira Product Discovery free.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

In an era defined by mass-market products, Discord had the foresight to see a new type of consumer behaviour emerging on the horizon:

Niche fandom.

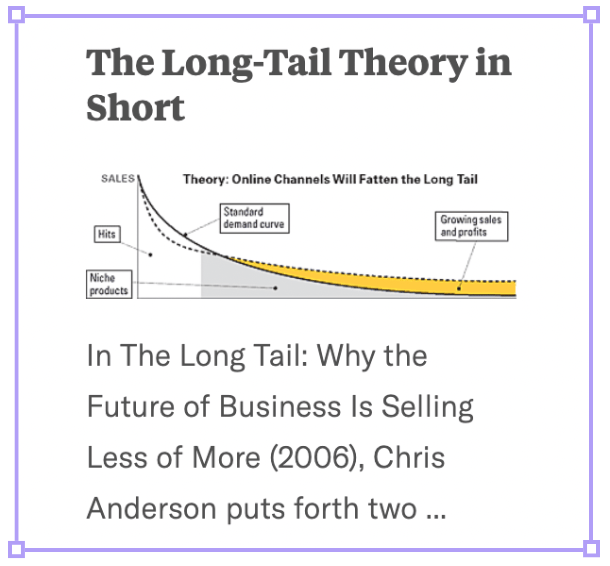

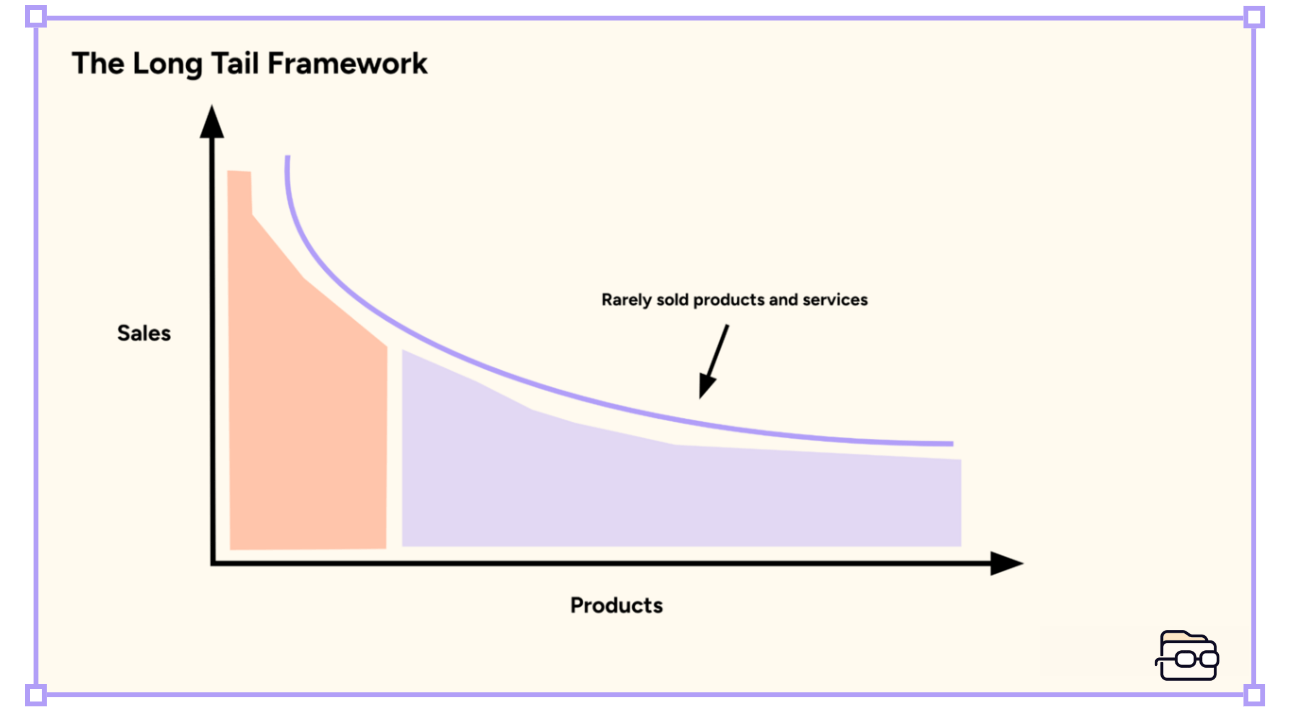

Popularised by writer Chris Anderson in 2006, the Long-Tail Framework suggests that a small number of products and services make up the “head” of the diagram. These offerings are widely popular, highly competitive, and few in number.

Conversely, an overwhelming majority of products and services make up the “long tail,” and are characterised as:

Highly-niche

Low mainstream impact

Potentially even “obscure”

Thus, conventional wisdom says companies should focus on costly big bets that could put their products in the head of the diagram.

Unfortunately, this strategy only works for a select few.

As consumer SaaS companies became more prevalent in the 2010’s, the market dynamics of the Long-Tail Framework were tested.

No longer bound by physical constraints, “unlimited digital shelf space” became the norm for companies like:

Netflix

Spotify

Amazon

These companies were able to provide blockbuster offerings, as well as service the long tail simultaneously. Early content strategies that were designed to connect with niche communities showed promise. Algorithmic recommendations made it easier for users to find communities that were aligned to their specific interests.

So Discord decided to eschew the mass-market and build a specific solution for one of the most passionate, yet forgotten communities in the world – gamers.

Discord avoided obscurity by tapping into it.

💡

Strategy Playbook: Learn how to support a single vertical ‘community’, then become home for all ‘communities’.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Don’t start with something for everyone – be everything for someone

When Discord launched in 2015, VoIP tools like Skype and Google Hangouts were building momentum in the traditionally cash-rich B2B segment.

Discord was born out of a need for more tools that promote dialogue in the gaming community – or in other words – more ‘discord’.

Their crusade for customisation started with the introduction of the Verified Servers program in 2019.

In 2021, they closed $500m in funding to develop gaming-specific product features, like:

Server boosting

Custom server branding

Server-level monetization

Stage Discovery Channels

Premium subscriptions & Nitro

Quests, allowing users to demo new games

SDKs and APIs to support custom integrations

Enterprise collaboration companies often shy away from customised workspaces, as they impair economies of scale.

Discord leans into them.

This has earned them a great deal of trust with their loyal user base. Their freemium product eliminates any meaningful barriers to entry for new users. And their server functionality, such as the ability to create multiple voice channels in a single server (vs. a large group chat), is conducive to building the micro communities that long-tail gamers crave.

2. It’s gaming AND, not gaming OR

Discord perfected the formula for gaming – but gamers alone don’t justify their valuation.

In 2021 during the pandemic, Discord hit the gas on expanding beyond gaming, looking to become home to other communities such as:

Arts

Film

Music

Education

Technology

Their expansion strategy worked. Extremely well.

A massive 78% of users today report they use Discord for non-gaming activities equally or more frequently than they do for gaming activities.

Discord was able to tap into new markets without alienating their core, by reappropriating core gaming features in other contexts:

Automatic roles based on team structure → Automatically assign roles to users in the San Francisco & Bay Area Server based on where they live

Server Bots with game updates → Server Bots that source relevant information for fantasy football managers in real-time

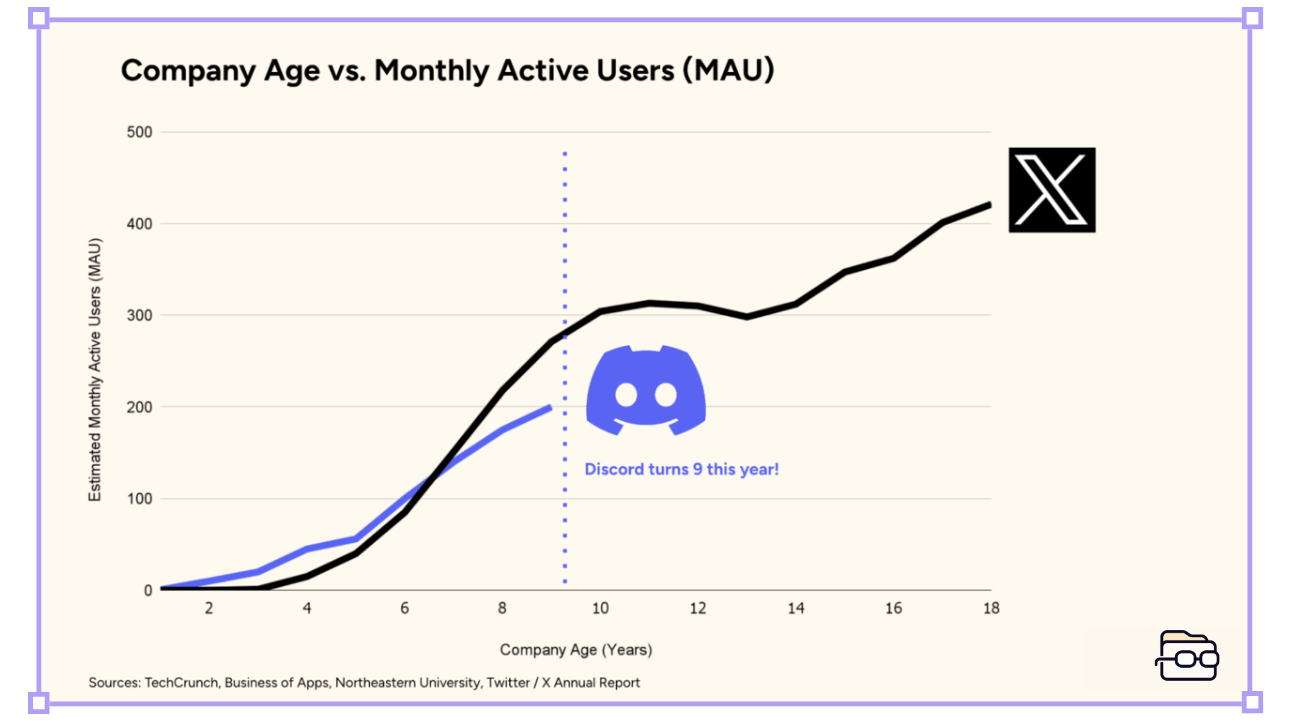

This has supercharged their growth to nearly 200M MAU.

Discord users skew young, with 60% under 25, and 90% under 35. This gives them the opportunity to grow with (and monetise) their audience as they age.

To put their scale into context, here’s how Discord stacks against another large community platform before their 9th birthday:

3. Prioritise a great product over a fast exit

Discord has raised nearly a billion dollars and touts a validation north of $15B. In 2021, Microsoft was considering an acquisition for $10+ billion.

Not a bad return for shareholders.

Yet, Discord made the decision to remain private despite pressure from investors who are eager to cash out.

This gives them more time to justify their lofty valuation.

Discord appears to be approaching the future as deliberately as it has the past, slow-rolling potential growth markets like:

International expansion, which requires compliance with local laws

B2B enterprise software for the workplace, which presents stiff competition from Slack and Microsoft Teams

By taking their time to develop the perfect formula for these customers – just as they have with gamers – Discord can transfer their long-tail product strategy to markets closer to the head of the curve.

And the early signs of this philosophy are promising – they’ve doubled sales since 2020 to over $600m and are once again eyeing an IPO.

Rabbit Hole

The where: 3x high-signal resources to learn more

[2 minute watch]

Always thought that Discord was a weird video game app designed for Gen Z gamer kids?

Think again.

Hear directly from the company’s marketing team in less than 3 minutes on how Discord works and how communities all around the world are using it to bring people together.

[20 minute read]

Legendary Harvard Business School professor Anita Elberse explores the groundbreaking long-tail theory and when it makes sense for digital brands to pursue these niche fandoms.

[45 minute listen]

Discord has been preoccupied with building the perfect product for small communities since the beginning. Listen to Jason Citron talk about their early strategy in 2018, including:

• Why the voice chat feature for video games needed a makeover

• How Discord differentiates themselves with game developers

• Discord’s roadmap for monetizing the network

That’s all for today’s issue, folks!

Don’t forget to check out the Strategy Breakdowns Tech Stack for an inside look at exactly how we’re running each corner of our operation.

— Written by Alex McClelland, edited by Tom Alder

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.