Read time: 4 minutes 6 seconds

Some behind-the-scenes fun for you:

Strategy Breakdowns is getting a facelift.

New colour palette. New design motifs. New brand.

Here’s the rough working direction.

What do you think?

— Tom

P.S. A quick ask: If you’re (a) a designer, or (b) handy with a Figma file - I’m looking for a new logo.

It’s always a treat working with readers, so send me a reply with some ideas, and let’s collab.

Today’s breakdown is brought to you by:

There’s a world where your CRM is powerful, easily configured, and deeply intuitive.

Attio makes that a reality.

Attio is a radically new CRM built specifically for the new era of companies. It’s flexible, easily configures to your unique data structures, and works for any go-to-market motion from self-serve to sales-led.

The next era of companies deserves a better CRM.

Loved by OpenAI, Replicate, ElevenLabs and more.

Make Your Next Performance Review a "How Much?" Conversation

StrategyHub teaches you strategy skills that instantly increase your value at work.

Learn the exact techniques used by top performers at Google, McKinsey, and Atlassian to get noticed and get promoted.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

Throughout the entirety of the dotcom bubble, there was a single peer-to-peer retail marketplace with national brand recognition:

eBay.

Even with Amazon eating into eBay’s sales for new products, eBay had cornered the market for used goods.

In 2011, Italian entrepreneur Simon Beckerman was looking for a way to build a community around his lifestyle publication PIG (People In Groove) Magazine.

He observed Instagram’s rising popularity, and imagined a product that afforded readers the same UX as the beloved camera-app, but instead allowed them to buy clothes worn by the creators in the magazine.

Somewhere community members could “discover” products organically, rather than searching for them on eBay.

Depop was born, with a defining philosophy:

💡

Strategy Playbook: Find something that’s boring, but working. Make it cool. Make it fun. Bring it to life.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Old game, new look

Despite their decade-plus first-mover advantage, eBay could never shapeshift into a brand that is coveted by Millenials and Gen Z:

→ eBay: always saddled with consumer trust issues, which was amplified by their minority acquisition of Craigslist in 2008

→ Depop: created a space that felt like home for under-40 consumers by allowing them to create profiles as brands, and enabling them to be both buyers and sellers

The user experiences are also highly representative of their respective ages:

→ eBay: primarily relies on search-based selling, requiring users to come with intent to purchase a specific item

→ Depop: leverages feed-based UX, which is more familiar to younger consumers, and facilitates the social and community aspects of the platform

And though one is very cash-rich, the other significantly more adaptable:

→ eBay: highly complex source code that is still built atop their legacy architecture, making large-scale UX changes challenging

→ Depop: simple modern design allowed them to quickly double-down on vintage clothing resale as streetwear took off in the mid 2010’s

2. Build a marketplace for humans, not transactions

Depop has always been obsessed with developing a mobile-first experience that:

Is optimised for both buyers and sellers

Specifically caters for apparel sales (since 95% of their Gross Marketplace Volume is apparel)

Has a vibrant underlying community

Their feed works similarly to other social apps, designed to algorithmically rank and surface various products for users to consider, which:

Gives it the effect of social entertainment, rather than traditional e-commerce

Makes the marketplace highly tailored, differentiating them from competitors like eBay and Mercari

Drives sales via intuitive, emotional, community-powered social tactics (ie. ‘impulse buying’) that gained traction in the mid 2010’s

Part of the appeal of Depop for Gen Z is the focus they’ve put on sustainability; these consumers are highly conscious of overconsumption habits.

According to Depop’s 2023 10-K:

“Depop’s circular ecosystem extends the life of millions of garments every year, providing a more sustainable way to enjoy fashion.”

Introducing humanity to selling is ultimately what created their market wedge.

Depop reportedly achieved around $650 million of Gross Merchandise Sales (GMS) in 2020, leading to their acquisition by Etsy in the same year for $1.6 billion.

3. Exercise strategic restraint

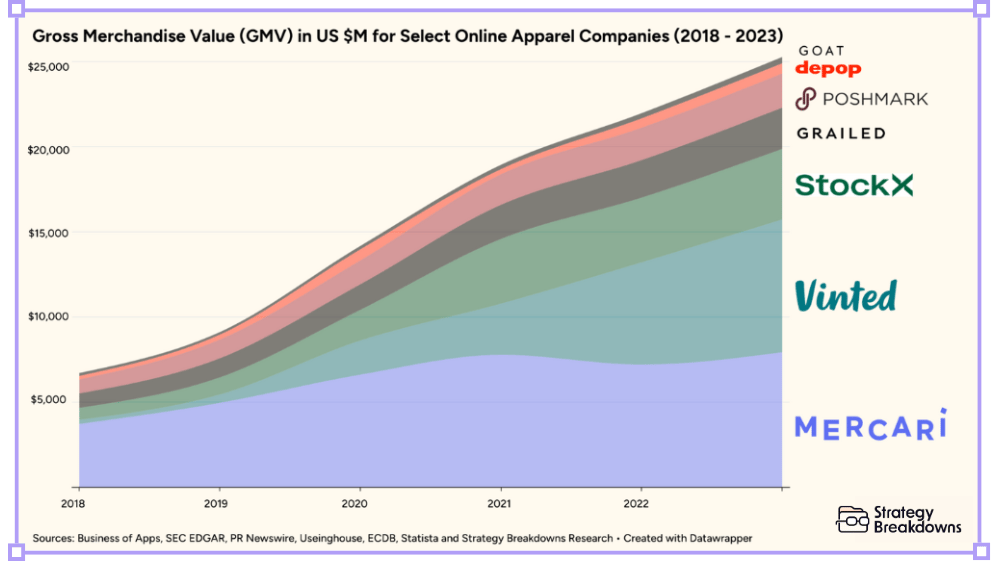

Vinted, founded in 2008, was the first major “next-gen” competitor to eBay. Over a 4 year period between 2011 - 2015, a slew of resale companies that specialised in vintage, exclusive, or resale apparel were born, including:

StockX

Poshmark

Grailed

Mercari

GOAT

Global competition for apparel resale exploded.

The clothing resale market is set to exceed $350 billion globally by 2027:

$70 billion will happen in the US. $38 billion will happen online.

Resale growth outpaced standard retail by 5x in 2023.

But the apparel figures are only a small fraction of the overall resale market – which is still dominated by eBay and TikTok Shop.

“Social” retail platforms like Whatnot, NTWRK, and TikTok Live, which came to prominence between 2015 - 2019, further accelerated resale growth.

These platforms focus on selling through livestream, a rapidly growing format in other markets:

Nearly 20% of online shopping in China takes place via livestream (worth $600B)

TikTok Shop (Douyin) aims for $12B in annual sales across Southeast Asia

By comparison:

Only 14% of American consumers have reported making a livestream purchase

The US and UK make up nearly 75% of Depop’s sales

While Whatnot, NTWRK, and TikTok Live compete in an arms race to win a prize that might not ever come to fruition (bringing livestream shopping to the US), Depop has doubled-down on building a social product that is specifically tailored to Western Gen Z.

And the livestream space could become even more competitive, as Meta and Amazon have both largely held out of this space so far.

Depop’s bet: Ignore the exciting but unproven - stay with what’s working.

Rabbit Hole

The where: 3x high-signal resources to learn more

[5 minute read]

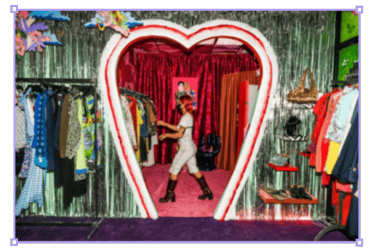

With over 3 million active Depop sellers, there are 3 million stories that inspired them to sell.

The WSJ explores the motivations of this community, 90% of which is under the age of 26, in an interactive lookbook.

(Hint, it’s not just about money)

[9 minute read]

Pre-owned clothing is having a major comeback, especially vintage.

This anti-trend is seen by young people as not just a way to express themselves – but also a tool to eschew the digital shopping experience altogether.

Explore New York City’s vibrant vintage clothing scene, one neighbourhood at a time.

[4 minute watch]

After taking over as Depop CEO in 2016 once founder Simon Beckerman stepped down, Maria Raga knew it was important to double-down on their strengths.

Check out the 2019 interview she did with Bloomberg’s Technology desk, nearly 2 years before the Etsy acquisition.

She covers:

• Why individuality and creativity is at the center of everything at Depop

• The importance of empowering its users to “build businesses”

• Depop’s plan for competing with Instagram

Don’t forget: we’d love some help / inspiration with the new Strategy Breakdowns logo. If you’re keen to collab, send us a reply!

— Written by Alex McClelland. Edited by Tom Alder.

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.