Read time: 2 minutes 24 seconds

Welcome to the 1,122 strategy nerds who have joined us over the last 2 weeks!

Join the growing community of 20,967 readers getting byte-sized strategy playbooks here:

This issue comes free with a reminder to ‘always play the long game’.

Before we begin... a big thank you to this week's sponsor.

My Playbook to Discover Hidden Opportunities

StrategyHub gives you the exact system I used at Atlassian to make high-impact strategic decisions using free online data.

Become your company's go-to 'insights person' by spotting patterns and opportunities that others miss.

“We need a front-end developer by Tuesday, but it’ll take months to find someone in the US”

We use Athyna at Strategy Breakdowns – and a bunch of our friends do too. If you are looking for your next remote hire, Athyna has you covered. From sales to marketing, ops to engineering.

The secret weapon for ambitious startups. No search fees. No activation fees. Just incredible talent, matched with AI-precision, at lightning speed.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

At a now-legendary executive retreat at Jeff Bezos’ house in 2003, Amazon leadership ran an exercise that changed the course of history forever.

The exercise started with a discussion about Amazon's core competencies:

→ Offering a broad selection of products? Check.

→ Fulfilling and shipping orders? Nailing it.

A few rotations later, they discussed IT.

As a rapidly scaling low-margin retail business, they had been forced to become market leaders at running reliable and cost-effective state-of-the-art data centres.

This little nugget presented an opportunity:

Amazon folded its highly-desirable architecture inside-out, offering compute, databases, and storage to the market under the banner ‘Amazon Web Services’.

Today AWS services 41.5% (!!) of all web application workloads.

History’s best example of ‘platformisation’.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. The AWS playbook: Turn costs → profits

Infrastructure → AWS

Payments → Amazon Pay

Marketing → Amazon Prime

Sales → Amazon Associates

Fulfilment → Fulfilment by Amazon

Product → Kindle, Basics, Fire, Echo, etc.

AWS kickstarted Amazon’s meta-strategy for new business lines: Transforming cost centres into profit centres.

2. Dogfooding done right

AWS became the infrastructure service provider to the Amazon.com retail store.

They made a point of treating Amazon.com no differently than any outside user.

This gave them the requirements, testing, and short feedback-loop they needed to develop fit-for-purpose services for the market’s largest customers.

3. Left hand feeding the right

Amazon.com’s flywheel can be summarised as: lower prices → increased sales → economies of scale → lower prices.

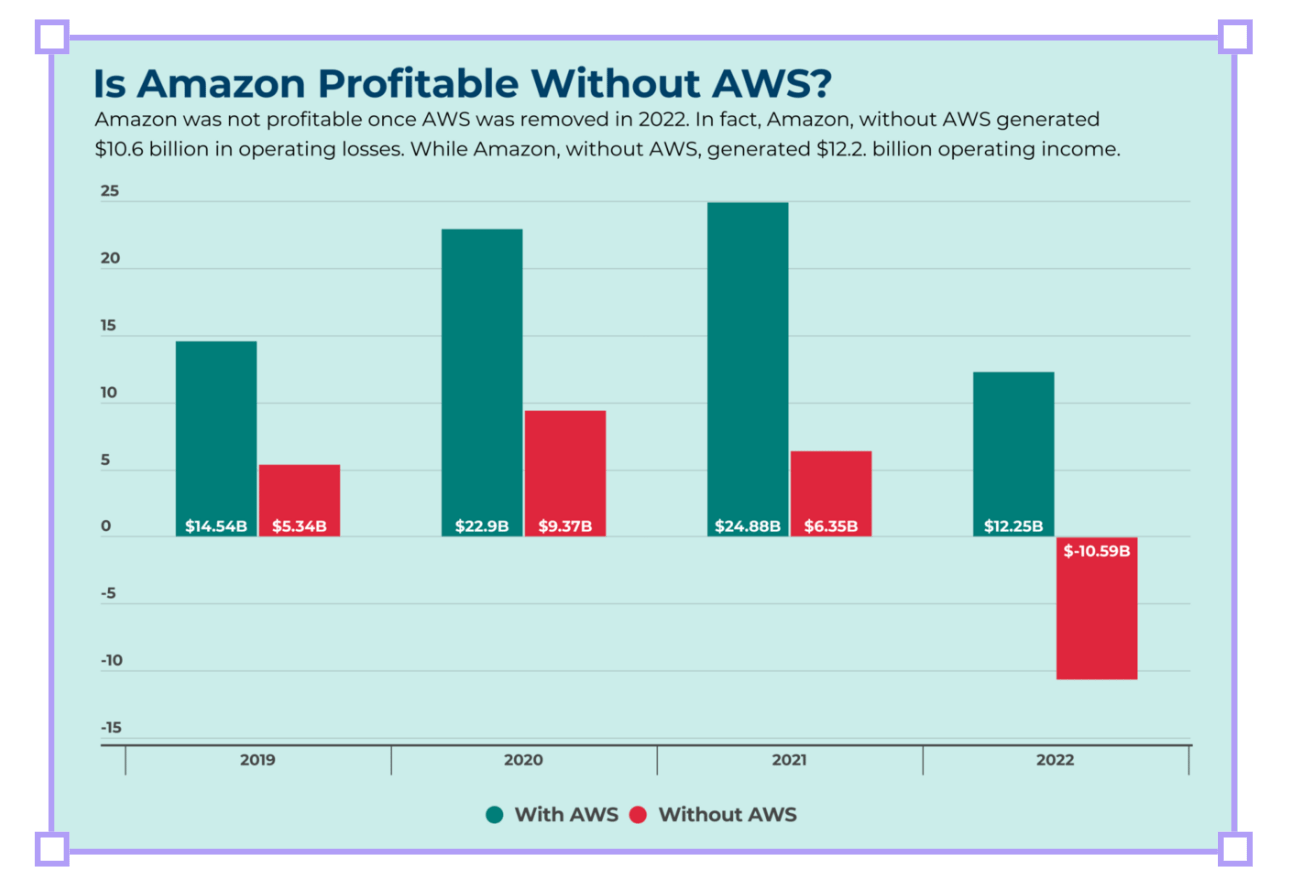

Despite pulling in a whopping 43% of $AMZN’s revenue, Amazon.com has razer-thin margins with high logistics and labor costs.

AWS however accounts for just 13% of $AMZN’s revenue, while clocking in nearly 75% of the company’s operating profit.

The takeaway?

AWS is the cash engine that subsidises Amazon.com’s impossibly low prices.

Rabbit Hole

The where: 3x high-signal resources to learn more

[18 minute read]

Ex-Amazon Google engineer Steve Yegge’s infamous rant comparing the 2 companies, in particular the platform/accessibility choices behind the Google+ product.

The best part - Yegge accidentally made the internal Google memo public on Google+, garnering massive media attention.

A mandatory read for tech historians.

[3 minute read]

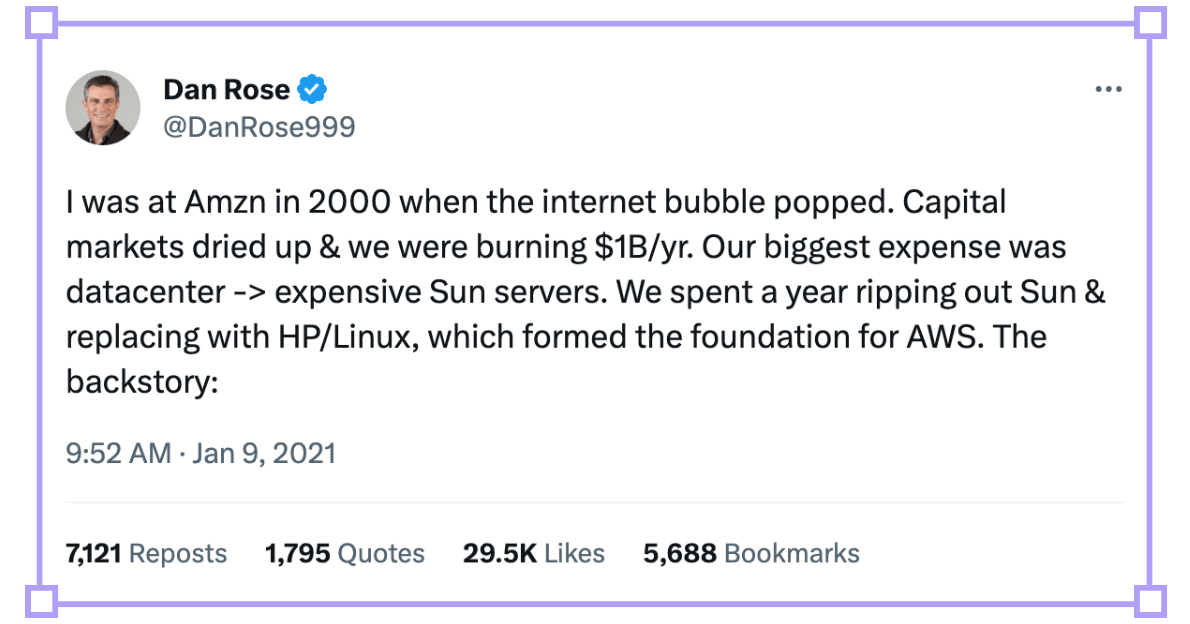

Amazon bet the house on an architecture transformation.

“If it worked, infra costs would go down by 80%+. If it failed, the website would fall over and the company would die.”

Makes switching calendar apps feel a little less daunting.

[4 minute read]

This one’s for the visual learners.

Cost structure, growth, margins, geo segmentation, and competitive analysis - a 360° visual breakdown of the AWS business line.

That's all for today’s issue, folks! Optimise your feeds by following on Twitter [@tomaldertweets] and LinkedIn [/in/tom-alder]

Got feedback on this edition? Any ideas for the next one? Reply directly to this email (plus it really helps with deliverability)

Thanks again for being here.

P.S. If you enjoy the newsletter, please forward to a pal! It only takes 10 seconds.

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.