Read time: 4 minutes 8 seconds

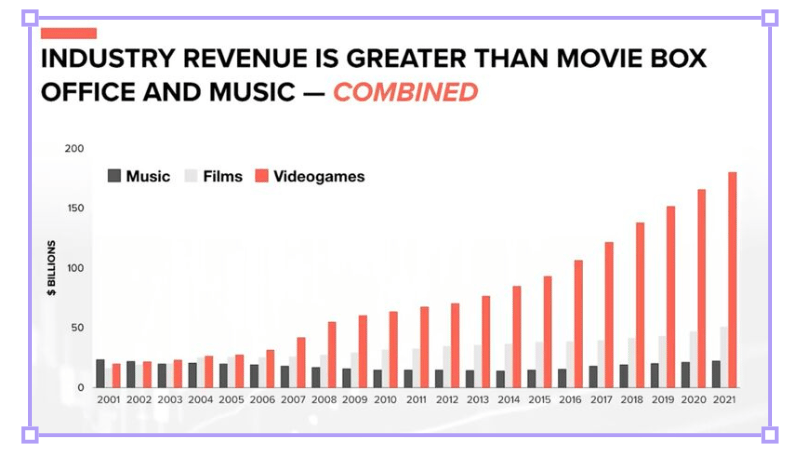

Whenever people indicate that they still think video games are a weird niche hobby, I now just send them this chart:

More specifically, mobile gaming is a much bigger thing than many appreciate.

The most popular gaming console in the world? The iPhone.

The most popular gaming store in the world? Apple’s App Store.

The largest revenue category in the App Store? Gaming (70% of App Store revenue)

Today’s breakdown explores one piece of the puzzle.

Enjoy.

— Tom

P.S. I’m a tragic collector of frame-breaking charts - if you have more like this, please share!

The dead-simple playbook to prevent customers from churning

I keep speaking to b2b SaaS startups using the same tactic:

Sign up to June.so

Install pixel on your website / product

Watch June automatically generate churn predictors and insights

Follow the personalised, data-backed recommendations for each customer

Become Leadership Material in 90 Days

Turn strategy skills into your career superpower with bite-sized, practical tutorials.

No theory, just actionable skills that instantly increase your workplace value.

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

New York Times is more gaming company than news publisher. Even the SEC knows it.

More time is spent on the NYT Games App than their News app.

But how did gaming become the foundation of NYT’s strategy to become the “essential subscription for English-speaking curious people to engage with and understand the world”?

The first NYT crossword entered the paper in 1942, quickly becoming a household favourite.

82 years later and I still haven’t finished this.

This continued into the digital era, with the crossword featuring on the NYT’s first website in 1996.

Crossword goes digital.

Today, over 850k people subscribe to NYT’s Crossword + 8 other ’human-crafted’ suite of games. This led to the NYT Games App to peak at #2 on Apple’s Free Games rankings, with over 8 billion plays in 2023.

💡

Strategy Playbook: Gamifying the subscription funnel

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Test before you invest

There have been three pivotal turnings points transforming games from the side-kick into the key enabler for NYT:

Release of the Mini Crossword (2014): Removed the paywall and high difficulty level, increasing accessibility to their classic crossword.

Release of the digital Spelling Bee (2018): Proved games could be more than just a crossword puzzle. Changed the way the NYT viewed games as it stacked paying subscribers on top of their Crossword games without cannibalising existing ones.

Acquisition of Wordle (2022): Brought in tens of millions of new users to the NYT Games, and ultimately NYT News too.

Throughout this process, the share of total NYT subscriptions coming from games increased significantly.

Business model in flux.

The NYT saw this as an opportunity to spin out Games as a standalone product line and establish it cornerstone strategic pillar.

From a silly little game to a key strategy driver.

2. Become a part of their schedule

The NYT is all about habits:

Read your daily news (the centre of it all)

Get your recipe for the day

See your daily sports journalism

Find your daily product deals

And now, play your round of Wordle, the Crossword, Sudoku, and whatever other games you enjoy.

The full daily habits package.

The goal of the gaming funnel? To transition you from:

→ someone who plays games

to:

→ someone who plays games and reads the news.

The NYT found that a user who has multiple ‘habit points’ is the stickiest.

As a primarily subscription-based business model, this stickiness is much more important for LTV than the ‘total time spent’ on their products (a typical NSM for other mobile gaming apps monetising via microtransactions).

Since minimising churn is critical for subscription sustainability, NYT defines success as “time-well spent” (as opposed to ‘time spent’) inside their apps.

3. Easy to enter means more will stay

In a pre-social world, paying for news was the norm.

Today, only ~17% of people paid for any online news in the past year.

Getting readers to pay for news is something publications have struggled with since the shift to the internet (ie decades).

To combat this, NYT uses free-to-play games to drive traffic volume.

Their organic search data shows the effectiveness of this strategy, with 4 out of the top 5 searches leading to the NYT site visits being games.

See the Connection?

(P.S. I recorded a free tutorial showing how I found this data. Check it out here)

NYT systematically feeds this search traffic into a subscription funnel.

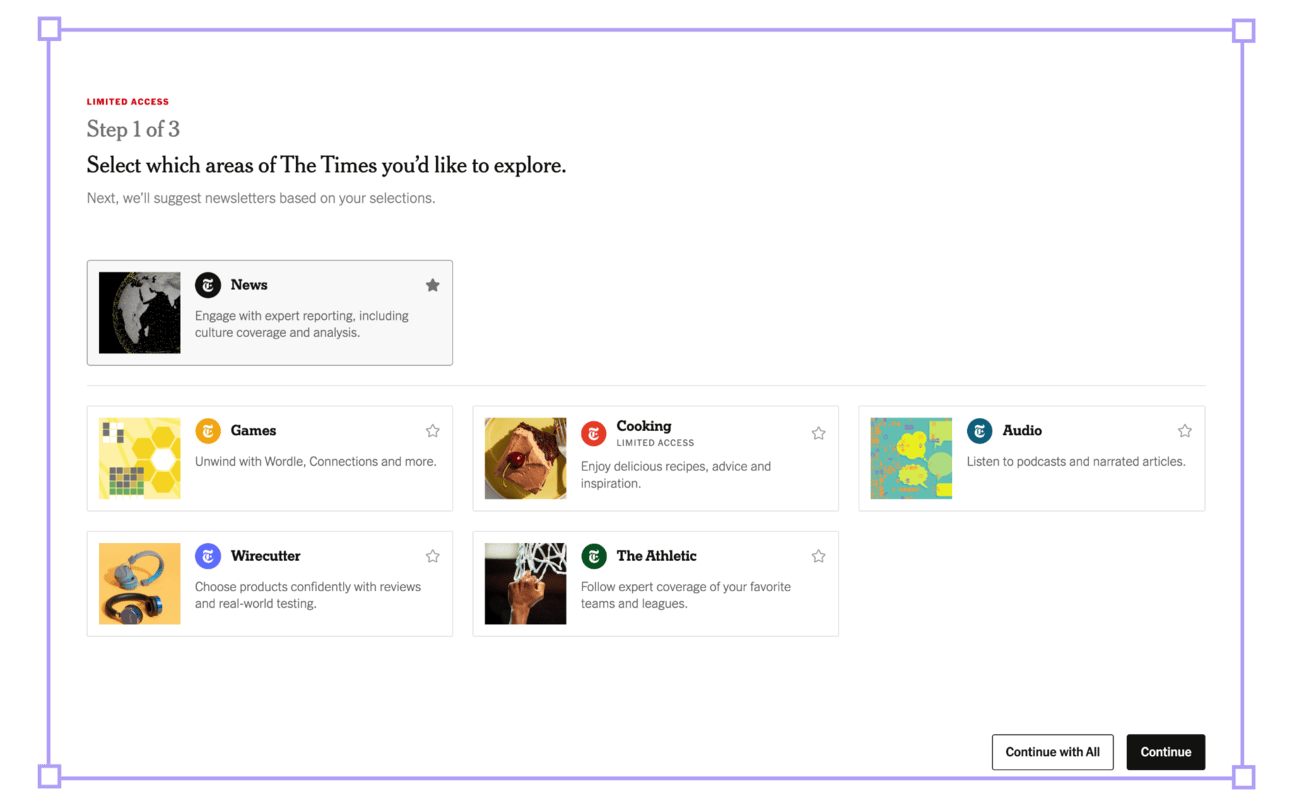

Play as a free guest → Create a free account → Sign up for a paid subscription

First Step: “Play”

They start by allowing guest users to play for free.

Second Step: “Log In”

Next they turn free guest players into free ‘logged in’ players by offering multiplayer and leaderboards to those who ‘Create a Free Account’.

Sign-in to show you’re the best.

Third Step: “Subscribe”

Finally they convert ‘logged in’ players into paying subscribers by offering more games, plus News, Cooking, Audio, The Athletic, and Wirecutter.

Converting the unconverted.

And that is how they turn ~10 million Google searches for “Wordle” into ~100,000 new paying NYT subscribers each month.

Rabbit Hole

The where: 3x high-signal resources to learn more

[16 minute watch]

I recorded this free tutorial teaching how I access traffic data, trends, and benchmarks for any website. Magical data for countless reasons.

Anecdotally I get a tremendous amount of value from this tactic for strategic market scans and ecosystem research:

→ e.g. getting a better sense of scale, reach, market share, and even top-line-napkin-math-revenue for companies I’m looking into.

[5 minute read]

Word puzzles on LinkedIn.

Logic challenges in The Washington Post.

NYT’s gaming strategy is no isolated incident.

Read their take on the industry-wide trend of gaming transforming internet media.

[1 hour listen]

Exploring the creative process of designing games at the NYT with Senior Games Producer, Jeff Petriello.

Interesting segment: their buy vs build strategy when it comes to adding games to the portfolio.

That’s all for today’s issue, folks!

Thanks for being here.

— Written by Sheldon Bishop and Tom Alder.

P.S. Seen a strategy you’d like us to breakdown? Send it in!

Whenever you're ready, here are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to partner with us and feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.