Read time: 6 minutes 40 seconds

Here we are. The final breakdown for 2024.

Exactly 12 months since I quit my job and went full-time on Strategy Breakdowns.

It’s been a defining year for countless reasons (standby for the full write-up early 2025). One of the most profound takeaways for me has been the compounding value of community; the synergies that form when people with similar interests and complementary ideas start building together.

I decided for today’s breakdown to pass the mic to a mentor who has played a huge role in this year’s trajectory - both from a business* and personal perspective.

Bill Kerr, Founder + CEO @ Athyna, Creator @ Open Source CEO (left).

Ziggy, Chief Vibe Officer (right).

Plus, the strategy he’s breaking down is a topic we nerd out on daily.

Handing it over to Doc.

Enjoy.

— Tom

* P.S. I made my first hire through Doc’s startup Athyna, and the experience was so flawless that I invested in the company. If you’re looking to hire global talent from a partner I can’t recommend more, click here.

There's a world where your product data generates revenue.

June makes that a reality.

June is a customer analytics tool built for B2B SaaS companies. It provides individual dashboards for each of your customers, tells you who needs help, and improves your customer retention.

The next era of companies deserves a better customer analytics tool.

Loved by Attio, Railway, Reveal and more.

Looking for top talent without blowing your budget?

Athyna helps you build high-performing teams faster—without sacrificing quality or overspending.

Here’s how:

AI-powered matching ensures you find top-tier talent tailored to your exact needs.

Get candidates in just 5 days, ready to onboard and contribute from day one.

Save up to 70% on salaries by hiring vetted LATAM professionals.

Ready to scale your team smarter, faster, and more affordably?

Thank you for supporting our sponsors, who keep this newsletter free.

Chess Move

The what: A TLDR explanation of the strategy

“Implement average strategies, get average results.” Someone must have said that at some point. If not, I’m saying it, here, today.

Howdy all, my name is Bill Kerr, people call me Doc (long story) and I am here to talk you through how we at my startup, Athyna, are thinking about GTM in a different way.

Why—”In a different way?” Well, if we go back to our original quote, I firmly believe that if you do what everyone else does, you will by definition be what everyone else is. Average. And who wants to be average?

Take it from me, I’m the guy who concocted a plan to send 1 million outbound emails a day—with a 50 person startup—two years ago and got a quarter of the way there before Google crashed our party.

So today we are going to talk through what we are calling our ‘Negative CAC creator-led media pyramid.’ At the end of the post, if you have a more apt name for this strategy, I’ll be pleased to hear it.

Ok let’s go!

💡

Strategy Playbook: Don’t just ‘create content’. Create media assets.

Breakdown

The how: The strategic playbook boiled down to 3x key takeaways

1. Try to make money, not lose money, when you advertise to customers

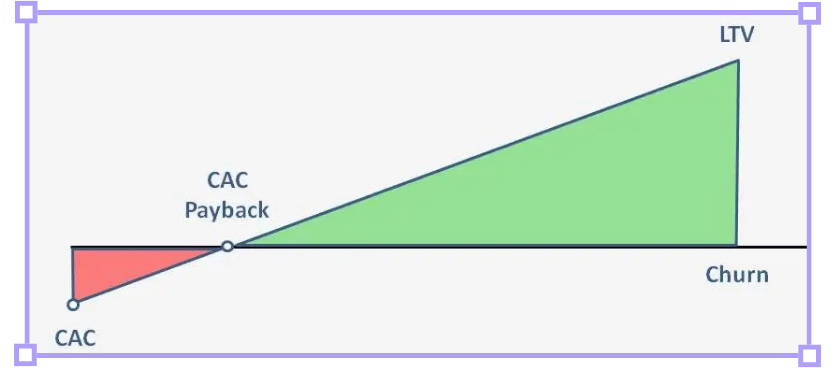

Firstly, it would probably behoove us to discuss the idea of ‘Negative CAC’. Customer Acquisition Cost (“CAC”) is how much a company spends to get a new customer, user, client, business in the door. It usually encompasses the Cost of Goods Sold (”COGS”) but also the indirect sales and marketing expenses—tech, budgets, salaries—associated with winning the deal.

For some companies, enterprise SaaS for example, the CAC might be tens of thousands of dollars. For companies like this newsletter you are reading today, CAC for a new email subscriber might be $2.

CAC Payback is the amount of time it takes to generate enough revenue from that customer to cover their cost of acquisition.

Lifetime Value (”LTV”) is the average revenue that a customer will generate throughout the lifespan of their relationship with your business. Let’s imagine you run a gym:

You spend $50 in Facebook ads to acquire a new customer (CAC = $50)

Membership is $40/mo (CAC Payback = 1.25 months)

Average membership duration is 10 months (LTV = $400)

The verdict? Time to start dumping money into Facebook ads as quickly as possible. If this is the maths you have a business.

So that’s CAC. But how on earth would it be possible to have ‘Negative CAC’ (ie CAC is less than $0)? ‘Are you telling me someone will pay you money to put customers in your pipeline?’

Well, sort of. Here’s how:

SaaS Tool X owns Media Brand Y, which sends a daily email newsletter.

Media Brand Y has an audience of 100k engaged subscribers and sells main ads at an industry standard $3000 and secondary ads at $1000.

Over the course of one Monday to Friday, Media Brand Y sells $20,000 in ad inventory, or let’s round it down to $15k assuming some unsold inventory.

They use the unsold ad slots to promote SaaS Tool X, which generate 10 leads, then eventually 5 opportunities, equating to $1M in pipeline.

20% win rate on opportunities, means 1 closed won deal at $200k of LTV.

Not only did they spend $0 on the ads to acquire the customer (CAC = $0), but their GTM channel actually made them money through other the other sponsorships in the daily newsletter (CAC < $0). This is a very crude example of ‘Negative CAC’, but you get my drift. It’s very possible. And it’s the playbook we run with my own newsletter, Open Source CEO.

2. Every company is a media company

There are a handful of examples of companies that are running some sort of ‘Negative CAC’ playbook today. Or at least buying up media entities to drive pipeline. One great example is The Motley Fool, a privately-held $100M media company founded in 1993.

The Motley Fool began as a media brand, then moved to media + subscription products, then again to media + subscription products + financial services. They now have $1B+ in Assets Under Management ("AUM") and reportedly do over $100M in revenue.

Another example is Robinhood who acquired MarketSnacks in 2019—and Chartr in 2023—to run the ‘Negative CAC’ playbook. If you take a look at December 20th’s edition of Snacks you’ll see it’s sent by Robinhood but presented by Hylio.

The email was also littered with a handful of other ads that would be driving the sweet sweet tasty nectar of revenue back up the chain.

But as I mentioned, they are not the only ones who are running some variation of this playbook. Have a look at the examples below of in-house media and/or communities acquisitions. Caveat: the Penn Gaming example didn’t end up as they’d hoped with Dave Portnoy re-acquiring Barstool Sports for one single solitary dollar last year.

Company | Target | Media |

|---|---|---|

Stripe | Indie Hackers | |

Pendo | Mind the Product | |

Outreach | Sales Hacker | |

Semrush | Backlinko | |

Penn Gaming | Barstool Sports | |

Mailchimp | Courier | |

Zapier | Makerpad | |

Amplitude | Data-led Academy | |

DigitalOcean | CSS-Tricks | |

Hubspot | The Hustle + My First Million | |

Robinhood | Snacks |

That sure is a hell of a lot of sweet sweet nectar right there.

3. Stack media assets for a content-led pipeline

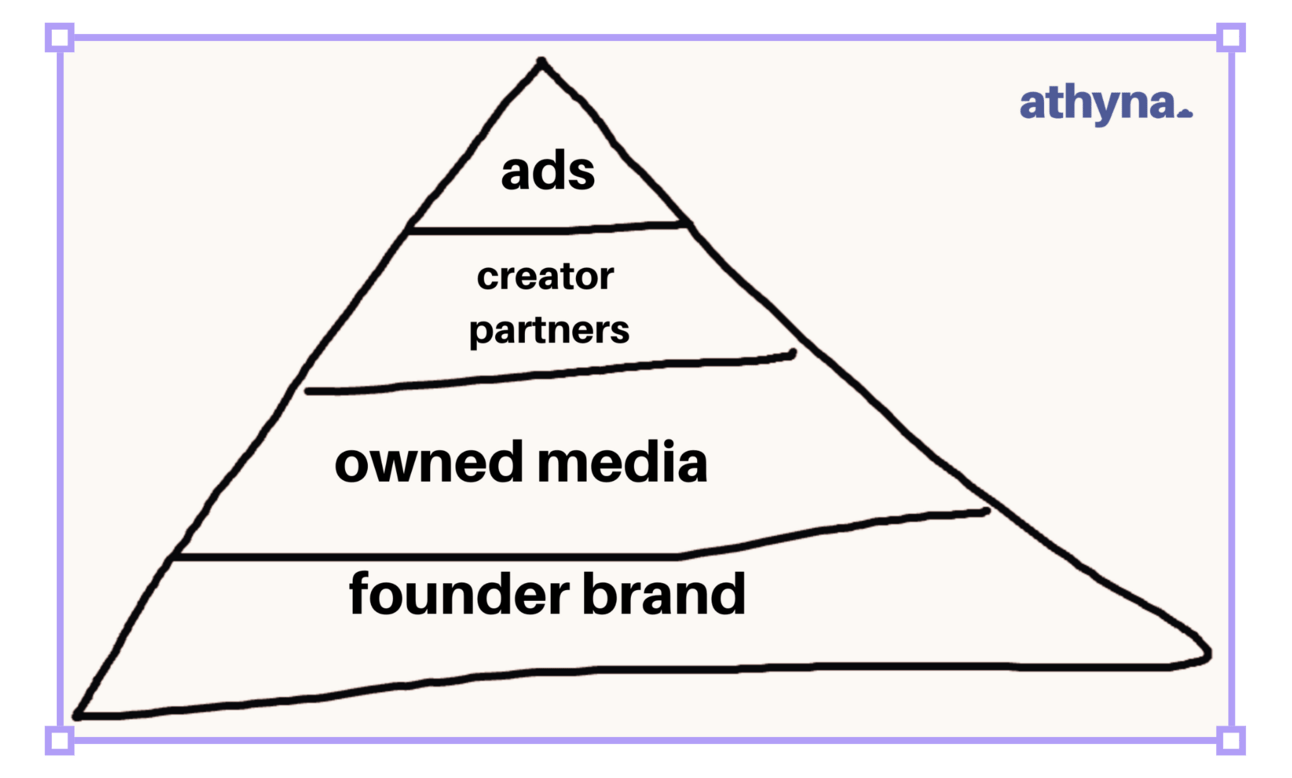

At my company Athyna, we are very bullish on a handful of things in 2025. And they all revolve around a similar theme. They are: founder brands, owned media, creator partners and good-old-fashioned newsletter ads baby.

Let’s take a step-by-step look into what that looks like through this crappy little pyramid diagram I created on Canva.

Founder brand: Businesses used to post a soulless monthly corporate update to their LinkedIn company page, and call it a day. That will no longer cut it. Today, that foundation of the pyramid is my founder brand. Yes, I may be an ego-maniac but it doesn’t mean it’s bad strategy. I post daily content on LinkedIn to ~30k followers, and write a weekly newsletter to ~70k subscribers.

My subscribers are founders, investors and leaders in tech, from companies such as; Canva, OpenAI, Google and more. My brand already drives a lot of pipeline, and that continues to grow.

My newsletter and socials drive top of funnel, but also act as a massive trust accelerator for people that are in the middle of our funnel.

“I would bet within 5-10 years max, a key component of a boards decision to make someone CEO is how big is their following.” — Scott Galloway

Owned media: The next stage of our plan that lays atop the foundation is owned media. Or in other words, media brands that Athyna owns, that can leverage the idea of ‘Negative CAC’. We are already well on our way with two stealth newsletters that are post-50k subscribers. Independent revenue drivers, that build pipeline on a consistent basis for us. Ka-ching!

Creator partners: Moving to the next layer of our pyramid is the creator partnerships we have built in the last few years. We raised a $2.5M round recently, and the majority of the round was filled by creators—tech newsletter operators to be precise. So we now have 15-20 creators / brands that have a vested interest in Athyna’s success, alongside large volumes of incredibly strategic newsletter ad inventory.

To put it into perspective, this initiative alone is now generating more than 50% of our pipeline with really strong prospects aligned with our ICP.

Newsletter ads: And finally, we plan to be one of the more aggressive players in the newsletter ad space. This is somewhat boring, but not really. We really love the ability to tell the story of Athyna through great newsletter partners, and become ubiquitous in the space.

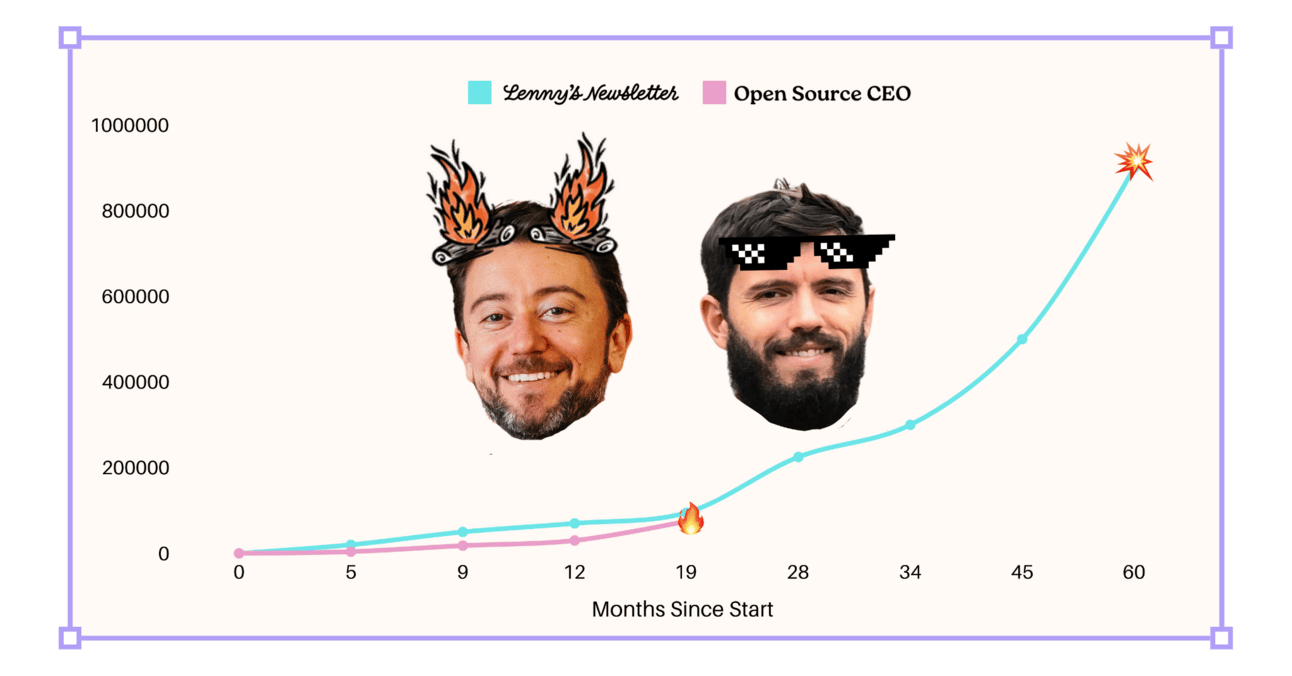

The longer term goal through my newsletter and our owned brands is to concurrently grow them both until Open Source CEO looks like Lenny’s Newsletter and the owned media arm looks like Morning Brew. Those are lofty goals, and of course, we may not hit them, but with the early runs we have on the board and momentum, we could.

And hey if we don’t, we are not going to fail a tenth of the way there. I think in two to three years time it’s quite likely that we are somewhere between 40-120% of where Lenny and Morning Brew are today. Not a bad result at all really.

Old media is dead or dying. People are the new brands, and earned media is the new way. And the less time an organisation needs to battle it out with literally everybody else—on the battle ground that is Meta and Google—the stronger the organisation will be.

Rabbit Hole

The where: 3x high-signal resources to learn more

[10 minute read]

I write a newsletter for over 70,296 founders, investors and leaders in tech who want to outperform the competition.

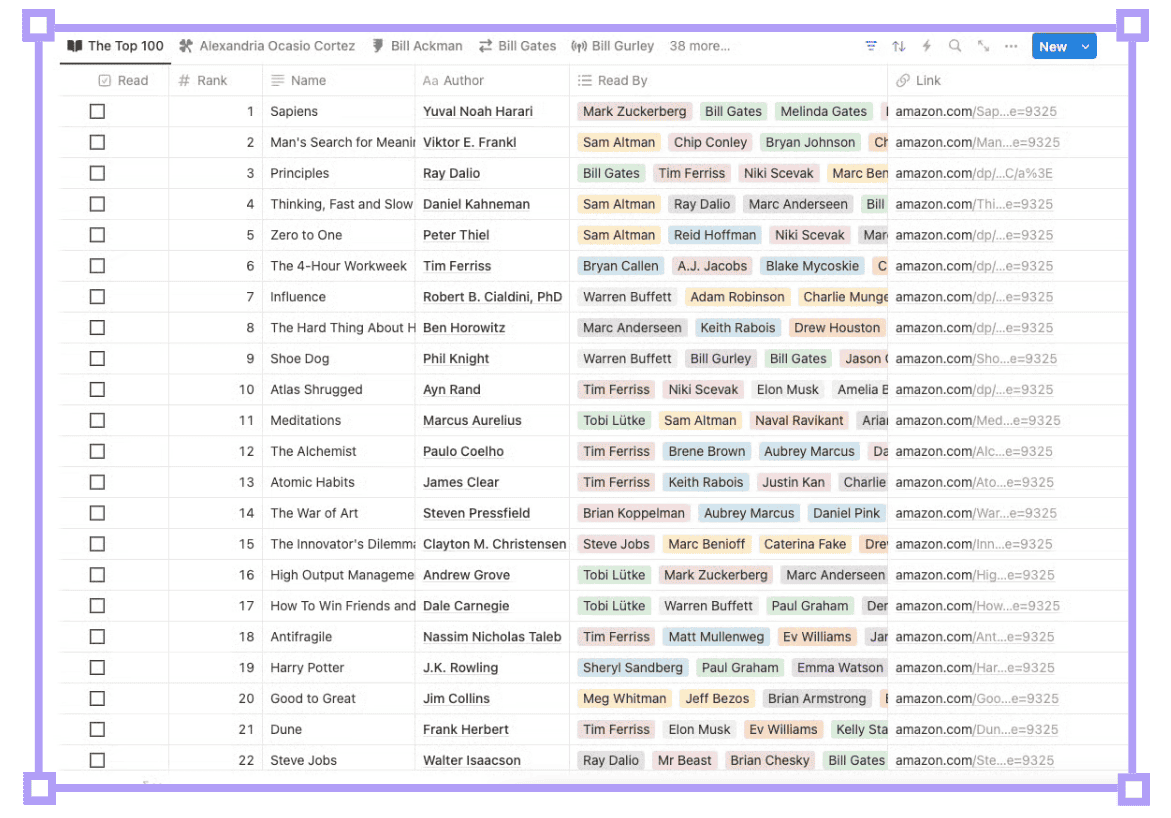

[Evergreen resource]

Here is a really cool database with the 100 greatest business books ranked by Elon, Steve Jobs, Arianna Huffington and more. Subscribe to get your copy!

[15 minute read]

This is a nice complimentary piece to today’s piece around the business of newsletters, and why a founder should have one.

That’s all from Bill - hope you enjoyed today’s email!

I've recently decided (after much convincing from friends and family 😅) to take some proper time off over Xmas, so we'll be back with the next breakdown on Jan 14th.

Have a wonderful break.

— Tom

Whenever you're ready, there are 3 ways we can help you:

Our flagship course on how to use free internet data to make better strategic decisions. Contains 5 years of strategy expertise, proven methods, and actionable tactics to accelerate your career with modern-day strategy skills.

We have a growing audience of 55,000+ strategists from top companies like Google, Meta, Atlassian, Stripe, and Netflix. Apply to feature your business in front of Strategy Breakdowns readers.

One of the most common questions we get asked is: “What tools do you use to run Strategy Breakdowns?” So, we’ve open-sourced our tech stack to give you an inside-look at exactly what tools we’re using to power each corner of this operation.